Financial Services: 7 Emerging Technology Trends That will Accelerate Your Digital Transformation

Money has always been one of the top priorities of humankind, and since it is one of the essentials, people have always been cynical about trusting others to secure their money. Even today, there are two billion people who don’t have a reach to a bank account in the world. The world was already going through a digital transformation, and the pandemic accelerated the process. Today, many of the daily routines demand a digital tool, and under these circumstances, unbanked people have it more challenging than ever. Considering that number is as high as one in four people, there’s an unseen financial crisis that has not much to do with economics as we know. Fortunately, mobile financial solutions and mobile payment solutions have come to the rescue. Here 7 emerging technology trends that will accelerate your digital transformation.

Banks may have been holding the monopoly of the financial services industry, but the massive demand from the unbanked is changing the climate in the financial industry. A new word even for the post-modern times, FinTech, is gaining popularity at an accelerating pace, which is eventually changing the rules of the game for any player in the industry.

With advancement after advancement in financial technologies, FinTechs have become as reliable as banking systems without the need for procedures, but calling this a competition between old and new would be too harsh, since conventional and radical are building a new future for the finance industry together with innovative financial technologies. In this article, we are going to focus on emerging financial technology trends, and how they can fill a massive gap.

- FinTechs are here to stay

- Artificial Intelligence will Dominate the Financial Services Industry

- Robotic Process Automation

- Bank & FinTech Collaborations is Becoming Mainstream

- Blockchain

- Big data is worth more than actual money

- Innovations in Mobile Payment Services

- What does Our MFS Platform Offer?

FinTechs are here to stay

A decade ago, it would have seemed nearly impossible for FinTech companies to even dream of doing what they are doing today. Whether we are talking about a digital wallet, a mobile payment service, or a financial super-app, FinTechs have taken the crown from the banks in terms of setting the financial services emerging technology trends.

Today 75% of the global population use FinTech services of a kind to send or receive money, but the majority of the financial technology services are still basic cash transaction applications, and looking at the investments in FinTech, a more advanced future for the financial services, in general, awaits us.

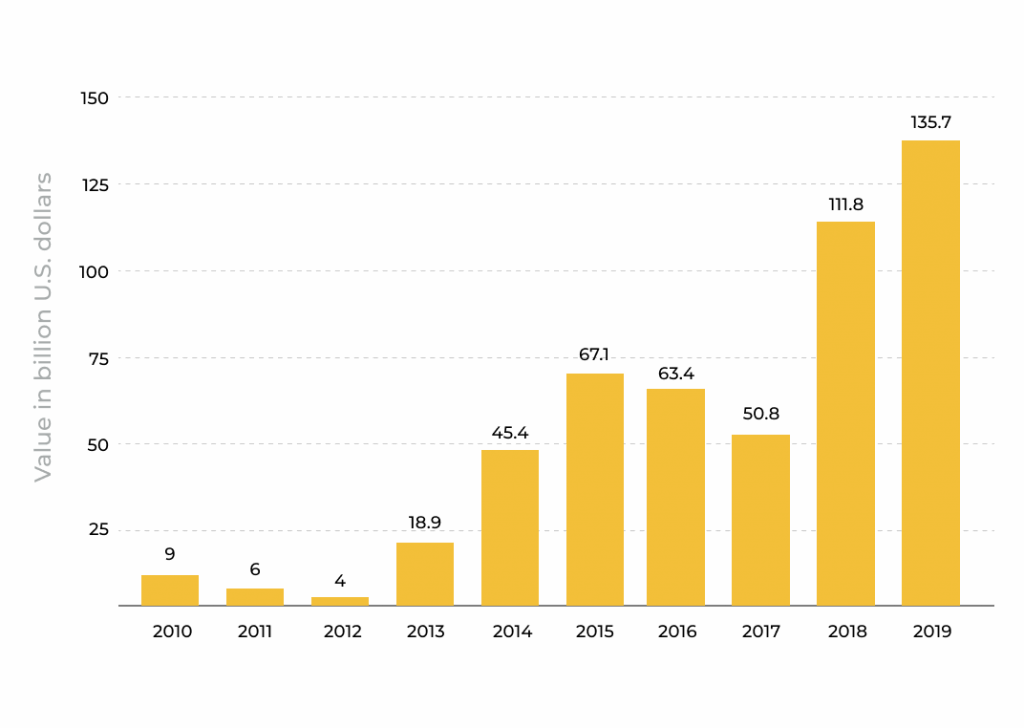

Looking at Statista’s chart, we see a boom in FinTech investment after 2014. Although the pandemic has slowed down the growth rate in 2021, projections are in favor of an even bigger growth in the FinTech industry. Below, we are going to dive deeper into subcategories or technological components of FinTech that will transform the financial services industry even more dramatically in the future.

Artificial Intelligence will Dominate the Financial Services Industry

Thanks to Artificial Intelligence, many of humankind’s daily workflows are turning into basic tasks. Today, AI is almost everywhere; even our washing machines and fridges are turning into AI-based devices, but this is only the beginning.

One of the biggest reasons behind the immense rise of FinTech start-ups was AI. Thanks to AI, small start-ups were able to meet the demands of their consumers with self-service options, which made them able to grow with a dramatically lower human resource compared to a conventional financial institution.

The only advantage of AI technologies in FinTech is not reducing the workforce; it’s also for the sake of users. According to Retail Dive’s report, 73% of consumers want self-service technology, and looking at the consumer behaviors of younger generations, the numbers are bound to rise even higher.

The only advantage of AI technologies in FinTech is not reducing the workforce; it’s also for the sake of users. According to Retail Dive’s report, 73% of consumers want self-service technology, and looking at the consumer behaviors of younger generations, the numbers are bound to rise even higher.

Robotic Process Automation

One of the biggest emerging technology trends in the finance industry is RPA, also known as Robotic Process Automation. RPA automates almost all of the workforce-requiring automatable financial processes such as customer onboarding, verification, risk assessments, security checks, data analysis and reporting, and compliance processes. In short, RPA saves companies a lot of time and budget. With the rise of AI, RPA systems today also observe and learn the workflows and automate them, placing conventional financial institutions like banks a little nearer to new-age FinTech services.

Bank & FinTech Collaborations is Becoming Mainstream

2020 was a big year for defining the future of banking. With Europe’s PSD2 movement, open banking has finally become the new normal for financial institutions, and the best thing is, it’s a scenario that everybody wins. Open banking regulations have opened the path for banks and FinTechs to work together. In a very short time, we’ve seen partnerships of FinTechs and banks like Bank of America & Zelle, Barclays & Flux, Royal Bank of Canada & Extend, and many more. Today, banks are offering their own financial services that are based on FinTech services, and FinTechs on the other hand are claiming themselves as new-age banks, creating a new category of financial services in general.

Another case in the finance industry is the branchless banking model that we have first seen after the economic crisis of 2008. In a financial climate that’s ruled by open banking, more branchless, all-digital banks are joining the picture. One of our clients, Vive Bank, is a great example of the branchless banking model that highly relies on futuristic technology and the freedom of open banking.

Blockchain

Although blockchain is an older concept, the rise of cryptocurrency has made phenomenal technology become widespread. Today, it’s one of the most secure ways to track money transactions, and even established financial institutions began considering the integration of blockchain technology into their systems. The technology allows anyone to transfer money without any banking system since the system includes literally everyone. According to The Harvard Business Review, blockchain will disrupt banks the way the internet disrupted conventional media. We are already in a decentralized world, and it’s time that our money follows the trend.

Big data is worth more than actual money

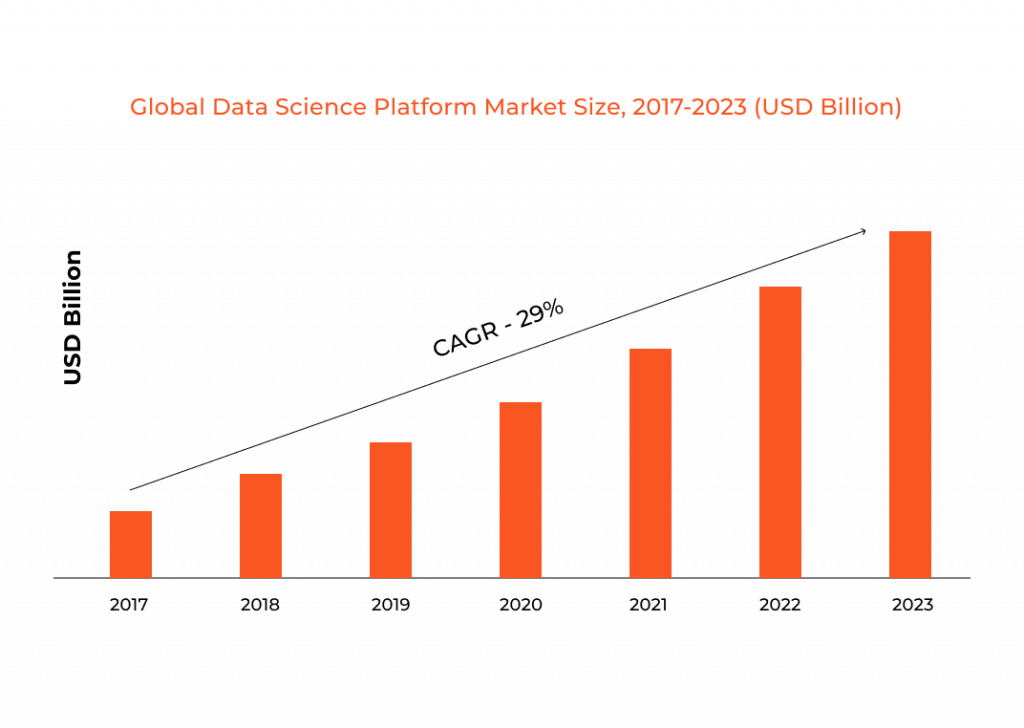

Data has always been essential for businesses, but for a decade, the value of consumer data has skyrocketed. The reason is straightforward; before the digital revolution, there were drawn-out procedures to gather accurate data on customer behaviors. Today, since everyone is invested in the digital world, it’s easier to analyze what people want from the services they use. The data market is clearly on the rise. Instead of doing surveys, companies need good data scientists that will tell them more than any other survey can.

Visionary companies have always found new solutions for collecting and analyzing consumer data, and financial services have become one of the trendiest data collection tools for businesses of any kind. Having a perception of customers’ financial behaviors apparently gives brands insight into ways to build better strategies. On the FinTech front, big data is the fuel for the technologies that we mentioned above like AI and even RPA, and building the base of the platform that takes advantage of the data is essential to thriving.

Visionary companies have always found new solutions for collecting and analyzing consumer data, and financial services have become one of the trendiest data collection tools for businesses of any kind. Having a perception of customers’ financial behaviors apparently gives brands insight into ways to build better strategies. On the FinTech front, big data is the fuel for the technologies that we mentioned above like AI and even RPA, and building the base of the platform that takes advantage of the data is essential to thriving.

Innovations in Mobile Payment Services

Another fast-emerging technology trend in financial services is undoubtedly mobile payment systems. The giants like Apple, Alibaba, Google, and Tencent are all aware of the financial demand of the future, and that’s only natural. Today, even companies who have nothing to do with finance are joining the game to give their customers a new and conventional payment and cash management method. With remarkable technologies like NFC and facial recognition, mobile payments have become more secure and convenient than credit cards, and it’s safe to say that in the future, nobody will carry a physical wallet with them.

A decade ago, to build a mobile payment system, companies needed to spend an enormous amount. However, today, there are ready-made systems that can be adapted to any business with very little effort, and the results are amazing. See why it makes sense for companies to outsource their mobile payment technology on our blog.

The biggest winners of the mobile payment integrations have been, as expected, the telecommunication companies. With their massive customer portfolios and technological backgrounds, telcos that are shifting towards FinTech solutions will likely be the major players in mobile payment and financial technology services.

Download our whitepaper on Telcos & Mobile Financial Solutions here.

We have partnered with two of Turkey’s biggest telcos, Vodafone and Turkcell to build mobile wallet services, and both companies have reached millions of users in a few years. You can check what you can do with Tmob’s mobile financial solutions platform and our case studies here.

What does Our MFS Platform Offer?

Here at Tmob, we have partnered with more than 100 businesses to create mobile payment systems, financial solutions, and unified online commerce platforms for more than ten years. Our Mobile Financial Solutions Platform offers a unified digital experience that works on every platform. With our platform’s integrated analytics tools, you can gather data on your customer profiles to build new strategies and increase your revenue while following emerging technology trends. Whichever industry you are in, you can integrate our platform for your needs. See what more you can do on our Mobile Financial Solutions page. See more on our product page or book a meeting with a Tmob expert to discover how we can help you.

Who are We?

Tmob | Thinks Mobility is a global technology powerhouse, specialized in digitalization and integration solutions, bringing growth and success to businesses and partners with its innovative SaaS, PaaS, and premium solutions since 2009 with Tmob Turkiye (TR) and Tmob United Kingdom (UK) headquarters.

Source 1 https://thefintechtimes.com/how-to-bank-the-unbanked/ 2 https://www.kite.agency/5-ways-fintech-is-changing-the-financial-services-industry 3 https://www.statista.com/statistics/719385/investments-into-fintech-companies-globally/ 4 https://www.mordorintelligence.com/industry-reports/ai-in-fintech-market 5 https://www.retaildive.com/news/study-73-of-consumers-want-self-service-technology/546044/ 6 https://www.asiablockchainreview.com/the-impact-of-blockchain-on-banks-financial-institution/ 7 https://www.marketresearchfuture.com/reports/data-science-platform-market-5201

- FinTechs are here to stay

- Artificial Intelligence will Dominate the Financial Services Industry

- Robotic Process Automation

- Bank & FinTech Collaborations is Becoming Mainstream

- Blockchain

- Big data is worth more than actual money

- Innovations in Mobile Payment Services

- What does Our MFS Platform Offer?