An Exciting Way for Data-Driven Business: Mobile Payment & FinTech Services

When we heard the term ‘financial technology’ a decade ago, the things that came to mind were bank services like virtual credit cards, mobile banking, and online payment security. Today, the term is one of the biggest elements of the digital transformation of businesses and, unlike a decade ago, banks are not the ones behind the tech.

Today, mobile financial services are one of the fastest-growing branches in retail, which may seem weird at first. However, when you think about it, it makes total sense. A retail newcomer to the FinTech universe, Walmart, says that it’s a step towards meeting customer demand:

– John Furner, CEO of Walmart U.S.

But there’s much more to offer a financial service besides meeting demand.

Mobile Payment Apps are the New Stars of Loyalty Programs

Walmart may be one of the first commerce giants to join the financial services market in the U.S. However, when we look at the Far East, we see the big shots of FinTech, like AliPay owned by the e-commerce giant Alibaba, which is one of the top two financial services in the area, and which transformed the whole financial system in China. On the other hand, although not as complex as Walmart’s solution, Starbucks transformed their loyalty program with loyalty cards, followed by a mobile payment service, years ago in the U.S. and Europe. This was a ground-breaking move towards the new age of loyalty programs. Now, we are entering a new era where the possibilities are nearly endless.

Even financial services like Starbucks Rewards were enough to have a great impact. With the latest technologies and solutions in the mobile financial services arena, we can safely say that it is bound to become a key element in building a data-driven business with a top-notch loyalty program. Here are the four main ways mobile payment services are improving customer experience and profitability:

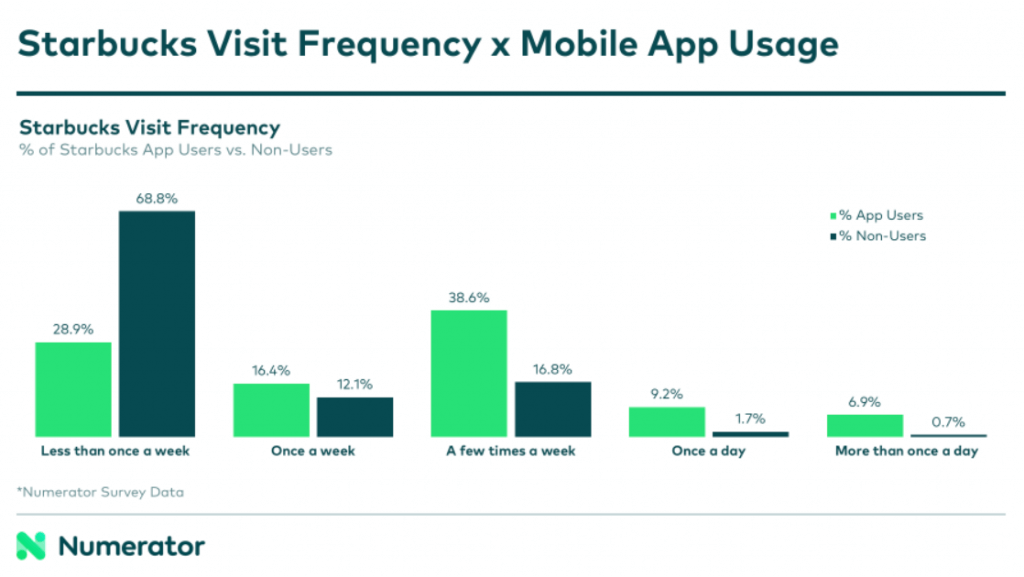

FinTech Services Raise Shopping Frequency

The main goal of loyalty programs is obviously raising the rate of returning customers. This is one of the biggest advantages of FinTech-integrated loyalty programs. According to Numerator’s report, 71% of Starbucks Rewards users visit a Starbucks once a week, compared to the 69% of non-users who visit a store less than once a week.

Bigger, Better Data Collection

Although conventional loyalty programs and loyalty cards are great for collecting customers’ shopping data, in today’s world they are not enough. With a mobile financial solution and integrated loyalty program, businesses can have a better understanding of customer behavior, income status, and even their lifestyle preferences. In the end, businesses get more data to analyze and then can expand in a better direction and build more realistic and successful strategies.

Personalized Offers and More

As younger generations are joining the consumer base, personalization is becoming more and more essential to retailers. The younger demographic is used to accessing lists of movies, series, and music they may like, so this is only natural. According to New Epsilon research, 80% of consumers are more likely to make a purchase when brands offer a personalized experience. We mentioned that retailer payment solutions are the best way to collect data, and with data collection on every level, better analysis, and the assistance of AI, you get tailor-made personalized experiences.

No More Commissions

Another reason many retailers are investing in payment solutions is for commission-free transactions. According to Nerdwallet’s report, some credit card companies can charge as much as 5% per transaction, which is a serious expense for retailers in the long run.

Let’s Build Your FinTech Platform in Months!

There is no doubt that mobile financial services or basic FinTech services will be mainstream in the foreseeable future and that, like everything else on this planet powered by competition, the first-comers will be the ones to stick around. Yes, building a FinTech app from scratch is extremely challenging, especially when you are in a different industry, but we live in a world of conveniences. Tmob can handle the work for you!

Here at Tmob, we serve businesses from many different industries, and one of our main focuses is on finances. Many industry-leading companies have taken their place in the future with our tailor-made financial solutions for e-banking and mobile payments, and you are welcome to join them. Our MFS platform, which offers P2P money transfers, a mobile application, mobile wallet, and AI capabilities that can be integrated with loyalty programs, is ready to be customized for the needs of your business. See more on our product page or book a meeting with a Tmob expert to discover how we can help you.

Who are We?

Tmob | Thinks Mobility is a global technology powerhouse, specialized in digitalization and integration solutions, bringing growth and success to businesses and partners with its innovative SaaS, PaaS, and premium solutions since 2009 with Tmob Turkiye (TR) and Tmob United Kingdom (UK) headquarters.

Sources: 1 Retail giant Walmart to launch a fintech (computerweekly.com) 2 Mobile Mastery: Insights into the Starbucks App | Numerator 3 Personalized experience for customers: Driving differentiation in retail | McKinsey 4 How Do Credit Card Companies Make Money? - NerdWallet