Vodafone Pay

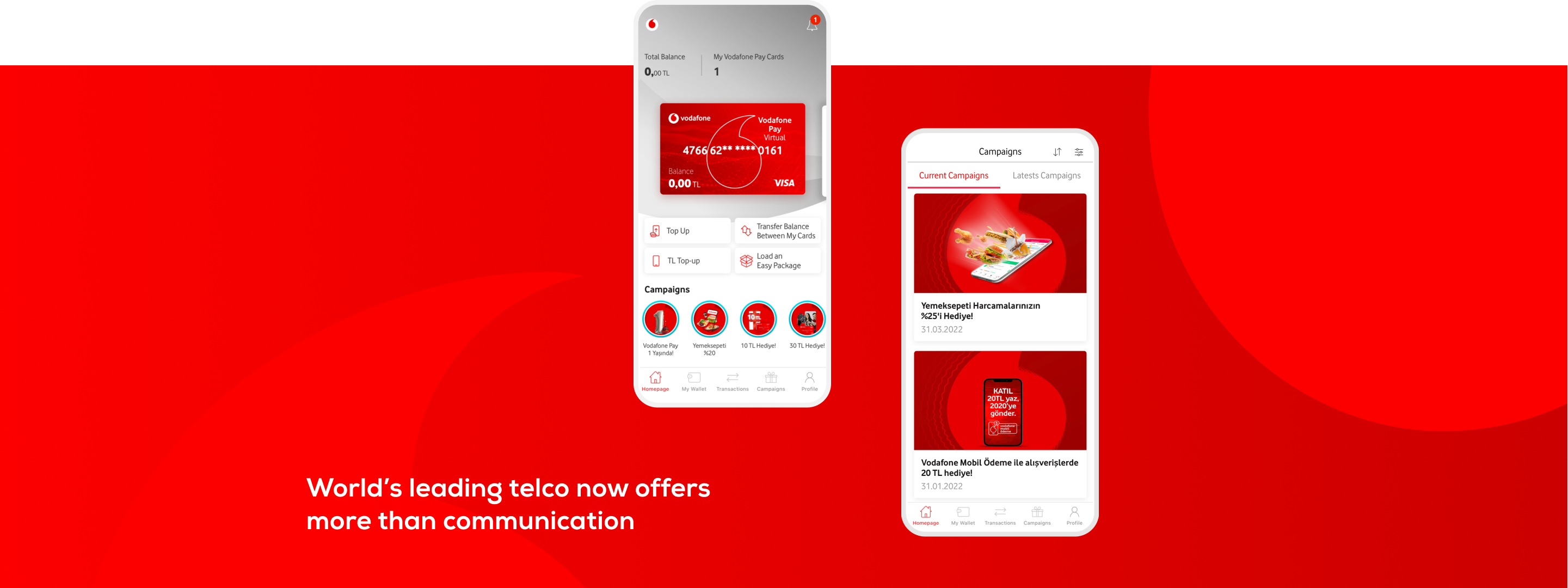

More than an e-wallet with the best-in-class fintech features.

Vodafone Turkey's mobile payment journey

Vodafone, one of the globally-successful telecommunications companies that has a strong presence in Europe, Asia, and Middle East, first launched its operations in Turkey in 2006. With a global presence, the telco had a wide vision about the ways for a telecom company to grow in the post 2010s, and they first rang our bell in 2014 with a fresh idea for Vodafone Turkey: a mobile wallet payment solution.

Vodafone

Realization: 2020

Vodafone

Realization: 2020

Changing the payment scene

The aim with the mobile financial solution was to introduce a new, modern payment method to Vodafone users and easily reach the unbanked and the underbanked in Turkey with an easy-to-use mobile wallet that lets users fly through checkouts and pay points and tills with just one tap.

Mobile payment, redesigned

In 2014, there were no other telecommunication companies or any other Turkey-based fintech solution in general that offered a mobile payment solution, which turned out to be both the biggest challenge and excitement point for Tmob, building a brand new product for Vodafone Turkey. After the success of Vodafone Wallet, the company rebranded their mobile payment service as Vodafone Pay, adding brand new features that meet the requirements of modern-day fintech applications.

Why vodafone has chosena ready-made, customizable MFS platform?

Vodafone says their biggest motivation behind working with Tmob for its mobile payment service was Tmob’s expertise on the field based on 200 seamlessly-working projects. The industry-leading brand also claims that their journey with Tmob was a standalone unique experience in terms of product road mapping, user experience & user flow, and product lifecycle management.

Vodafone Turkey and Tmob’s partnership has left seven years behind, and it is growing bigger. Today with Vodafone’s satisfaction with the Vodafone Pay project, our partnership is about to go aboard with six more European regions.

Our solutions

Our tailor-made, customizable MFS platform offers every aspect of a modern-day fintech service; here are the top features that we implemented to Vodafone Pay.

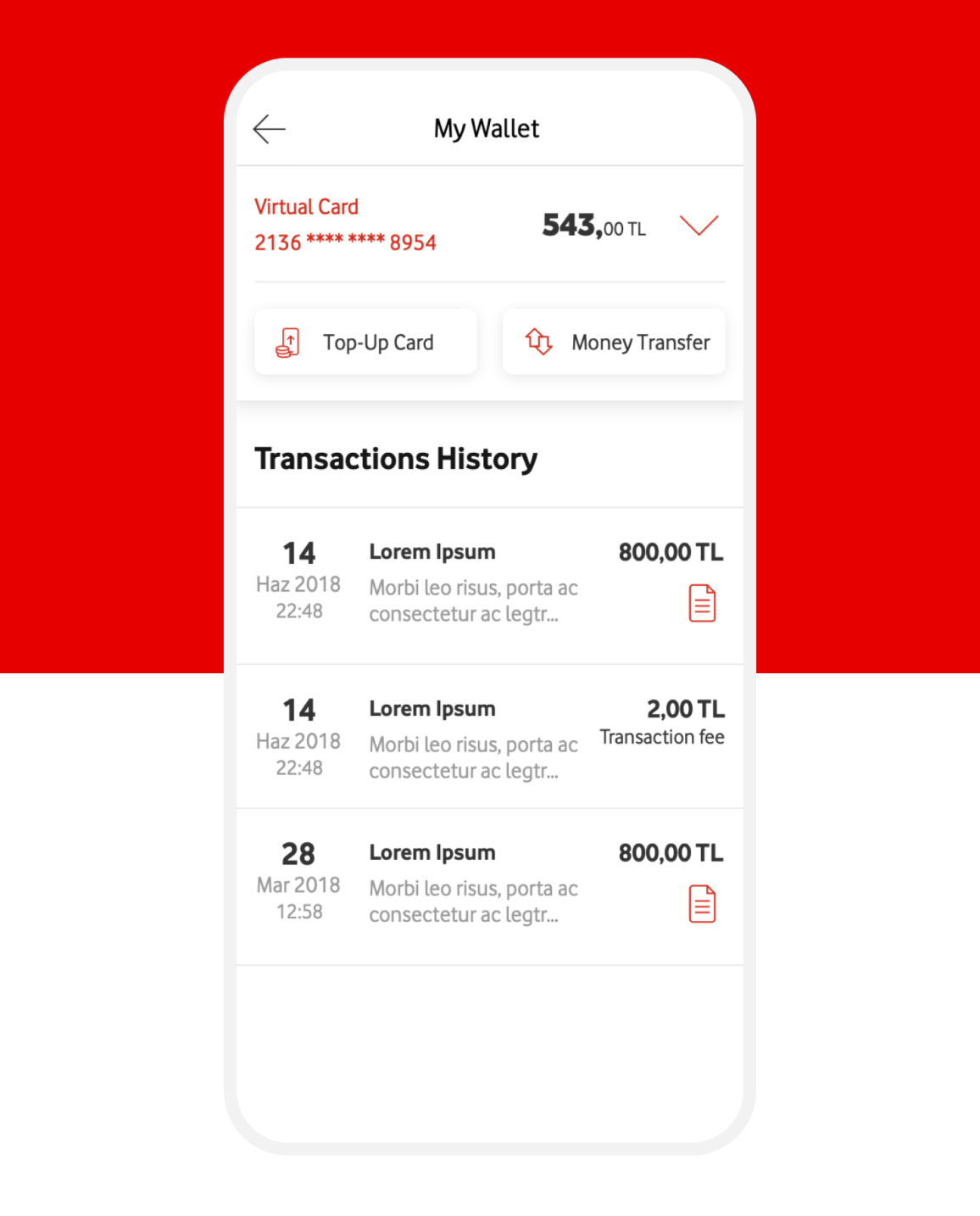

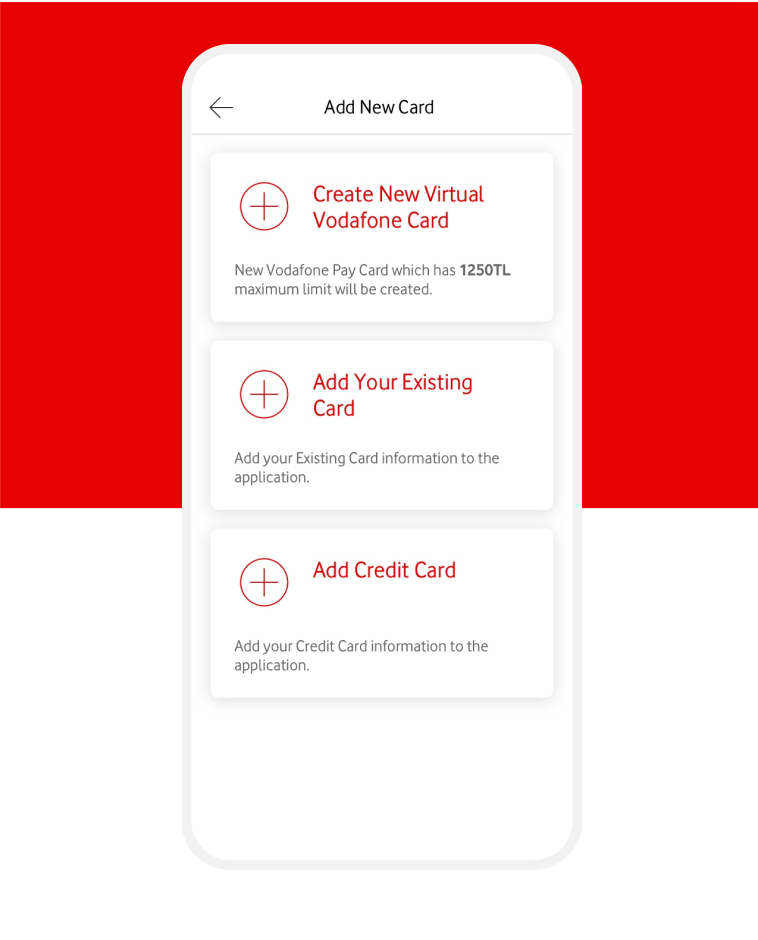

Fintech design at its best

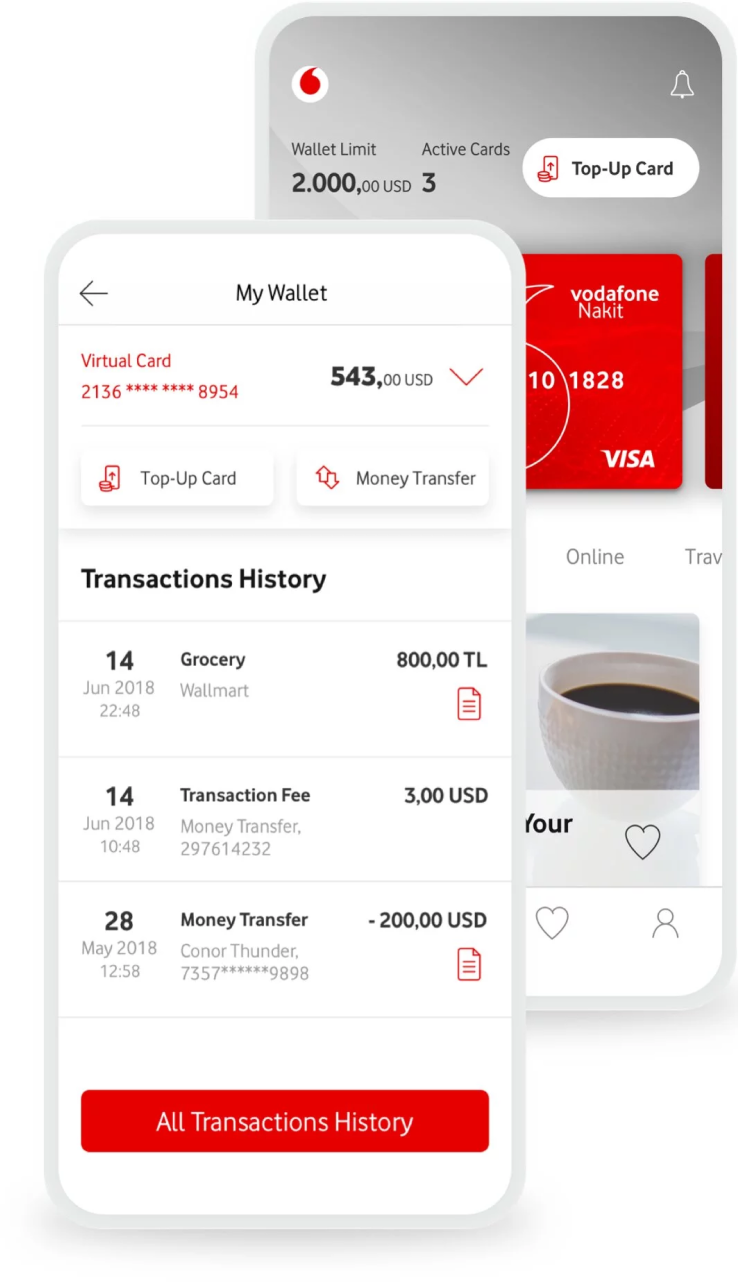

We designed the Vodafone Pay mobile app for everyone to use, banked or unbanked. With it’s easy-to-use interface, users can create virtual cards, make transactions & payments, and keep track of their financial histories with a double of taps.

A payment hub for everyone

Vodafone made a breakthrough with our first MFS partnership, Vodafone Wallet as the first company to offer a mobile wallet to its customers, and the e-wallet application has been downloaded by 300.000 people across the country. The service and the application was awarded Mobile Excellence Awards-Best Retail/Commerce Solution for Mobile and Best Mobile Payment in 2014.

The successor to Vodafone Wallet, Vodafone Pay, has been downloaded by over 250.000 people in less than five months, and users have made more than one million transitions over Tmob MFS Platform.

As of 2021, Vodafone Pay has been downloaded by over 250.000 people in less than 5 months and there were more than a million transitions passed over Tmob MFS Platform. Together, we have planted the first seeds of the mobile money revolution in the country, and our collaboration is now expanding to six more European countries. As a result, Vodafone loves Tmob, and our feelings are mutual.

300.000 Downloads

Best Retail/ Commerce Solution for Mobile of 2014

Most Used Mobile Wallet

A payment hub for everyone

Vodafone made a breakthrough with our first MFS partnership, Vodafone Wallet as the first company to offer a mobile wallet to its customers, and the e-wallet application has been downloaded by 300.000 people across the country. The service and the application was awarded Mobile Excellence Awards-Best Retail/Commerce Solution for Mobile and Best Mobile Payment in 2014.

The successor to Vodafone Wallet, Vodafone Pay, has been downloaded by over 250.000 people in less than five months, and users have made more than one million transitions over Tmob MFS Platform.

As of 2021, Vodafone Pay has been downloaded by over 250.000 people in less than 5 months and there were more than a million transitions passed over Tmob MFS Platform. Together, we have planted the first seeds of the mobile money revolution in the country, and our collaboration is now expanding to six more European countries. As a result, Vodafone loves Tmob, and our feelings are mutual.

300.000 Downloads

Best Retail/ Commerce Solution for Mobile of 2014

Most Used Mobile Wallet