22 Fintech Trends for 2022 That Every Manager Needs to Know

As well as transforming people’s way of performing everyday financial tasks, the fintech industry is also transforming itself thanks to its highly-disruptive nature. Every year, we hear at least one or two new terms in the financial arena that rapidly become the next big fintech trend, and 2022 seems like no exception. As a SaaS and PaaS company that has been highly involved in the transformation of financial services, we decided to share our list of fintech trends for 2022—here are our top 22 financial technology trends that’ll shape the future of fintech.

- DeFi (Decentralised Finance)

- White-Label Fintech

- Mobile Payments

- VR in Financial Technology

- Smart Contracts

- Robotic Process Automation (RPA)

- Voice-Enabled Payments

- Data Aggregation

- Autonomous Finance

- Biometric Identification

- Sensors and Internet of Things

- Machine Learning and AI

- Gamification

- Quantum Computing

- Open Banking

- Virtual Cards

- Big Data

- Flexible Payment Allocations

- Platform as a Services (PaaS)

- Payroll Fintechs

- Non-finance Companies Offering Fintechs

- User Experience Optimisation

DeFi (Decentralised Finance)

Since the emergence of blockchain-based currencies, the idea of decentralised finance is becoming stronger and stronger, and for a couple of years, it stopped being a romantic idea. Thanks to peer-to-peer networks that rely on fault-proof infrastructures, a decentralised financial future is possible, but we think that it’s not going to eliminate the current, highly-centralised financial system—it’ll absorb it in to bring out an even more secure, democratic, and people-friendly financial system.

There’s no doubt that DeFi is becoming bigger, which is why many of the 2022 financial trends that we’ll list rely intensely on the decentralised future of financial institutions.

White-Label Fintech

The digital revolution came with many wonderful things, and white-label solutions are one of the latest to join the party. For many industries, the best, risk-free way to build an operation are through white-label platforms that accelerate the whole process. As a company that’s been in the white-label fintech area for years, we can make sure that it works perfectly.

In an age where agility becomes more essential, outsourcing financial technology to join the hype train is becoming more and more mainstream. Today, not only financial institutions join the fintech game. And even for financial institutions that are following the conventional rules of finance, using a white-label fintech solution saves a lot of time and resources compared to starting from scratch. Here at Tmob, we have two main white-label finance solutions that help businesses accelerate their financial endeavours: MFS Platform and E-Banking Platform.

Mobile Payments

We know that sooner or later money will become all-electronic, and so will the wallets. The change is already happening, and like in many other scenes, the thing that’s replacing our wallets is the mobile devices. The digitisation of money works for almost everyone: banks, governments, fintechs, the unbanked & the underbanked, and everyone who wants a scoop of the mobile money market, including telcos and e-commerce giants.

The mobile wallet revolution has already taken over China thanks to the super-app giants AliPay and Tencent, and Europe is one of the most willing regions to follow the mobile payments trend.

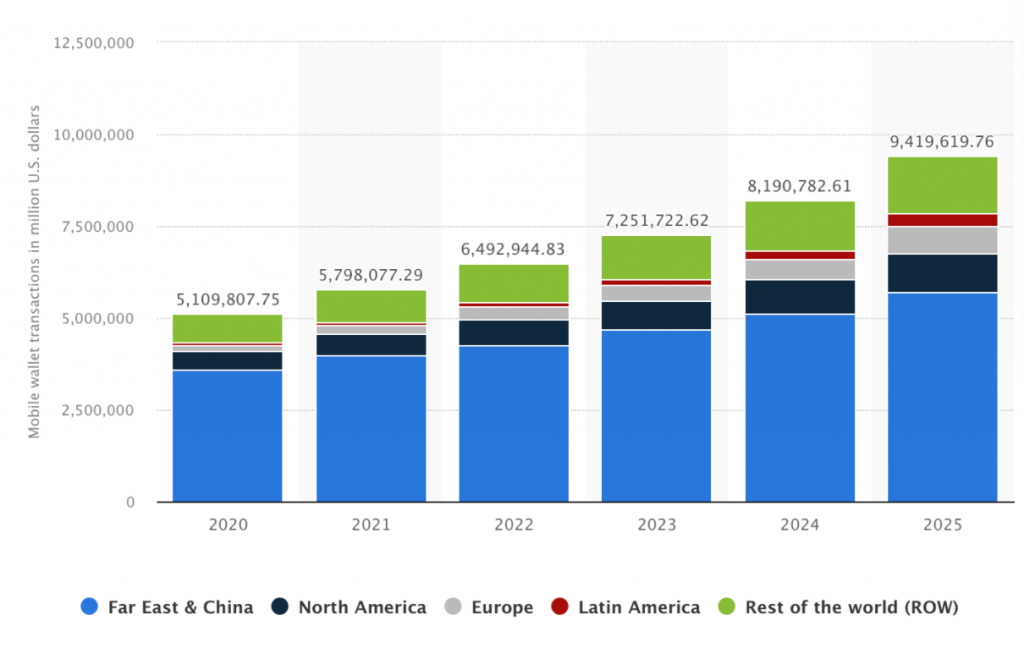

Source: Mobile Wallet Transactions Market Size Statista

In five years, the global mobile payment market size is expected to reach $12 trillion, with a growing CAGR of 30.1%. With white-label fintechs and non-financial brands joining the game, it wouldn’t be too naive to expect mobile payments and mobile money transactions to exceed the predictions.

VR in Financial Technology

Virtual reality is once again the hot topic thanks to Facebook’s rebranding as Meta, only a few years after the launch of popular VR headsets by Oculus. There’s no doubt that the internet is not going to look like what it is today in a few years, and if you think it’s a phase that everyone’s talking about the metaverse, you may be wrong. According to the report by Goldman Sachs, the virtual and augmented reality industries are expected to exceed 80 billion USD in market size in only three years. As you’d expect, the alternate, virtual universes that we’ll build will come with its own rules and economy, which will probably be handled by financial technologies, blockchain, and new-age payment solutions. Who knows; meta universes may even create their own meta-fintechs.

Smart Contracts

Another big example of decentralised finance, smart contracts, has begun becoming widespread thanks to third-party service providers that take advantage of blockchain technology. In short, a smart contract relies on a code-based agreement between two or more parties, and the biggest advantage is the elimination of the middlemen. One of the nicest examples using the smart contract model is Compound Finance, which lets users take short-term loans via depositing Ether. Thanks to the openness of the system, many fintechs that seek ways to get into loans without giant financial institutions will be able to act more or less like banks.

Robotic Process Automation (RPA)

One of the revolutionary technological advancements of the last decade has been RPA. It’s basically making a computer perform repetitive tasks without errors, and the finance industry is one of the most fitting areas for the technology. There are tons of tasks in the finance industry that are already being handled by RPA, including streamlining accounts, fraud detection, tax reporting, and more. But on the fintech front, things get even more exciting with RPA.

The industry has already begun implementing the benefits of RPA, and many finance industry leaders believe that RPA will be an essential part of fintechs.

CEO at Connetpay, Marius Galdikas, shares his thoughts on RPA and the finance industry. Thanks to automation, fintechs and branchless banks can join the competition with as few human resources as possible and offer a seamless, fault-free finance experience.

Voice-Enabled Payments

One of the most controversial topics in the financial technology industry, voice-enabled payments still remain with safety concerns for many. But companies like Apple, Amazon, and Google are finding new ways to make the technology as safe as possible, and here at Tmob, we are closely monitoring the advancements of what seems to eventually become a key element in financial transactions.

Data Aggregation

Thanks to the new regulations, data aggregation in finance is finally becoming mainstream with the most transparent way possible. Even before open banking regulations, there were financial data aggregation companies like Yodlee, and in the brave new fintech world, we’re going to see more fintechs that focus on utilising financial data for the sake of users and third parties altogether.

Autonomous Finance

Self-service is one of the hottest topics of the digital industry. Automated chatbots, self-service guidelines are becoming more and more popular, and the reason is not even profitability; it’s customer satisfaction. For the customer, being able to take loans, open an e-wallet, or having full control of their stocks and digital currencies is more advantageous on many fronts. International Banker’s report on autonomous finance highlights the importance of the matter with the following:

“Autonomous finance’s appeal is its ability to support individual customer journeys at scale. Rather than solely being a cost-cutting vehicle, autonomous finance can lead to better end-user outcomes.”

Biometric Identification

Biometric identification is among the top trends in the fintech industry. For example, in China, Alipay is using facial recognition to verify payments. The use of biometrics for identification is not just limited to payments. All over the world, banks and fintechs have started using fingerprint authentication for all their banking transactions, and as biometric technologies become more widespread in mobile devices, it’s going to be the most secure way to go for identification in the finance industry.

Sensors and Internet of Things

Every other day, we see a new everyday object connected to the internet, and predictions state that the number of connected devices will reach 64 billion by 2025. The IoT impact on finance is already happening, and with new devices joining the ecosystem, we’ll have a bigger disruption in the financial sector. With connected devices, banks and financial institutions can eliminate the middlemen, in this case mostly humans, all together to create a more streamlined and convenient financial flow between devices.

Machine Learning and AI

The first application of AI in finance was over 100 years ago when ATMs were first introduced. Nowadays, AI is used for trading, investing, and managing large portfolios of assets such as stocks and bonds. This is happening because AI can gather immense amounts of data, analyse it quickly and precisely without bias, and make logical decisions.

Gamification

Gamification has been widely used by enterprises to increase engagement and user retention rates. Over the past few years, fintech companies have increasingly adopted gamification to attract and engage customers, too.

As a growing trend in digital services, gamification comes with new use cases every day, and finance companies have already begun taking advantage of the new and fun way of engaging with customers. For example, Monobank has implemented a mini-game into its app that lets customers make transactions by shaking the phone.

Another data-centric approach in gamification in the finance industry was launched by Moven. With a gamified process, Moven, a fully-digital bank, gathers behavioural customer data to create a better service across all of its operations.

Quantum Computing

Computing power is an important aspect of the success of any business or financial organisation. When it comes to storing and processing data in a secure and efficient way, Quantum computing technology is the best option in the current scenario, but there’s still a lot to achieve for the technology to become widespread. With quantum computing, calculations can be made faster and more efficiently than with traditional computing technologies, which results in a higher level of risk management for any financial organisation.

Quantum Computing contains design features which make it ideal for use in the finance domain, such as dense packing, which accelerates the whole computing process and reversible operations, which makes it possible to undo operations smoothly.

Open Banking

The biggest revolution in the banking industry, open banking, began transforming the way people, banks, and fintechs interact with each other, and it’s going to open new ways that banks can collaborate with fintechs. According to research by the Economist Intelligence Unit, 45% of business leaders in finance expect an evolution towards a digital ecosystem that’s highly connected between banks, fintechs, and third-party contributors.

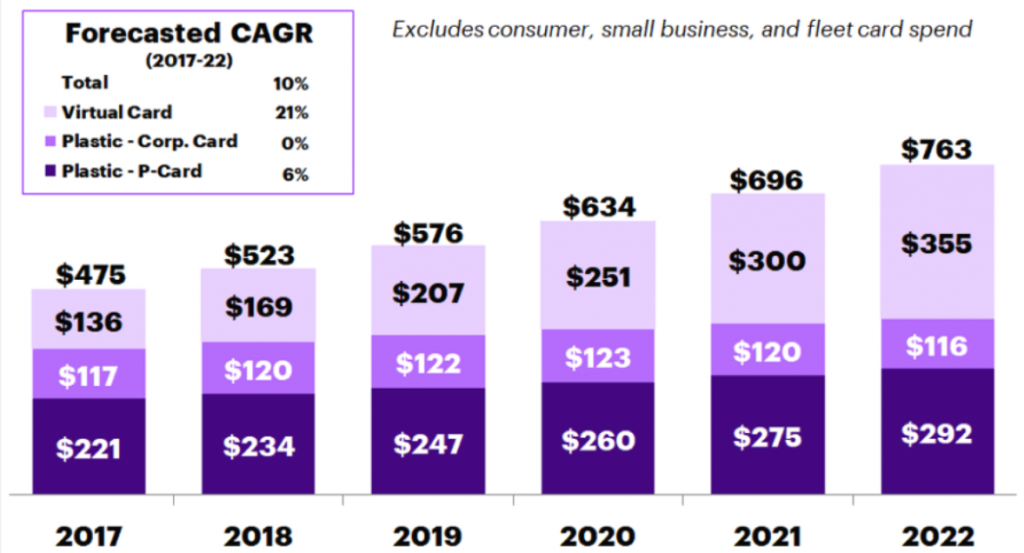

Virtual Cards

Virtual cards are one of the new and innovative ways of shopping that is becoming more popular with many people. There are many different reasons that can explain the growth of these cards, but it is believed that the fact that they do not have to be physically present for them to work may have played a key role in their growth. They are safe, sustainable, and can be created with a couple of taps, and according to Accenture, virtual cards have the biggest growth potential in the future with a CAGR of 19%.

Source: Accenture

As they eliminate the need for plastic cards altogether, virtual cards seem like the best way to go hand in hand with mobile wallets, fintechs, and even loyalty-based financial solutions.

Big Data

The most valuable asset of the digital age, data, is becoming more and more essential, and with new regulations, there’s no reason for financial institutions not to take advantage of the giant ocean of data. Today, approximately 1.1 trillion megabytes of data is generated by almost 5 billion internet users. When this massive pool of data can be equated into the financial data of users, it can bring out an extremely bright future for every party.

Fintech companies have already begun taking advantage of big data to create new-age solutions for their users, like creating better savings plans and better investment ideas. But there’s one thing that’s likely to impact the industry even bigger: customer experience.

Recent studies show us that 80% of customers think a personalised customer experience is as important as the service itself, and 66% of customers expect companies to predict their needs. In such an atmosphere, financial institutions that implement big data into their customer experience processes will become the real winners. At Tmob, we’ve been taking advantage of customer data to create a better customer experience with our e-commerce solutions, and with open banking, we’re implementing our platform skills into our financial solutions as well.

Flexible Payment Allocations

One of the new ideas in the fintech industry is emerging to hit banks where they are the strongest. With buy-now-pay-later and save-to-buy models, fintech companies like Clearpay, Klarna, and Laybuy are offering users a new perspective to streamline their shopping habits. Who knows; we may even see the new fintech model shrink the credit card market size.

Platform as a Services (PaaS)

If you’ve come this far in the article, you must have noticed that financial technologies have long passed the point of being the business of financial institutions alone. Every kind of business on the market is after its share of the e-money cake, and finance platforms as a services (PaaS) are the best ways to jump on the train. As a PaaS company that has a decade-long experience in the fintech field, we can make sure that whichever business needs to implement financial solutions into their operations can do it within a year thanks to customisable, tailor-made platforms. Our answer is the Tmob MFS Platform that’s already transforming many telcos’ and e-commerce businesses’ financial technology needs in the quickest and most innovative way possible.

Payroll Fintechs

Another thing that fintechs are revolutionising interests small businesses: payrolls. Today, fintechs like Tide are streamlining the payroll process of many UK-based SMBs in the easiest way. The best part is, the whole process can be handled for a far fewer price tag.

Tide CEO Laurence Kriger says that they aim to take the pain away from the payroll process with the following:

Expectedly, Tide is not alone in the payroll fintech arena, and there are many more joining the game from the MENA and European markets as well.

Non-finance Companies Offering Fintechs

Money is already no longer money as we know, and the transformation is happening quicker than ever predicted. The most fundamental tool in commerce is finally becoming fully-digital. For more than a decade, companies have been trying to find ways to become the next mediators of money, but recently, everybody seems to want to join the game, even the ones that have nothing to do with finances.

Today, almost every medium-to-big-sized company is trying to implement financial technologies into their ecosystem one way or another. There are many perks for non-finance companies that are stepping into fintech, but if we need to name a couple, better loyalty programs and taking revenue from the cash flow would be the main reasons.

User Experience Optimisation

The future of finance is undoubtedly in apps, and when we say apps, the first thing that comes to mind is the hot topic of the last decade: user experience. In an age where 90% of users state that they will stop using an app if the performance is poor, it becomes even a more essential element for a highly competitive area like the finance industry. Thankfully, it’s not very challenging as it used to be to give the user what they demand.

Creating a seamlessly working application is the easiest part of the path to creating the best user experience. In this age, we should be talking about the user demand to bring out the best experience, and that’s where elements like in-app user behaviour come into the picture. So, while developing a fintech service, adding the user monitoring elements into the process is essential, and with a tailor-made, data-centric PaaS solution like the Tmob MFS Platform, you don’t have to worry about it.

Sources: 1- https://www.statista.com/statistics/1227576/mobile-wallet-transactions-worldwide/ 2- https://www.alliedmarketresearch.com/mobile-payments-market 3- https://www.goldmansachs.com/insights/pages/technology-driving-innovation-folder/virtual-and-augmented-reality/report.pdf 4- https://compound.finance 5- https://www.missioncriticalmagazine.com/articles/93673-rpa-is-the-key-for-growth-in-fintech 6- https://www.yodlee.com 7- https://technative.io/8-advantages-of-iot-in-banking/ 8- https://relevant.software/blog/gamification-in-fintech-examples/ 9- https://apis.pe/wp-content/uploads/2018/10/Apis_Partners_Gamification_of_FS.pdf 10- https://www.weforum.org/agenda/2021/04/open-banking-future-of-finance/ 11- https://bankingblog.accenture.com/slice-700b-us-commercial-card-spend-up-for-grabs 12- https://anywhere.epam.com/business/fintech-and-big-data 13- https://www.cushmanwakefield.com/en/insights/the-edge/are-millennials-and-gen-z-powering-a-fintech-revolution 14- https://www.unleash.ai/fintech-startups-disrupt-payroll/ 15- https://websitebuilder.org/blog/user-experience-stats/

- DeFi (Decentralised Finance)

- White-Label Fintech

- Mobile Payments

- VR in Financial Technology

- Smart Contracts

- Robotic Process Automation (RPA)

- Voice-Enabled Payments

- Data Aggregation

- Autonomous Finance

- Biometric Identification

- Sensors and Internet of Things

- Machine Learning and AI

- Gamification

- Quantum Computing

- Open Banking

- Virtual Cards

- Big Data

- Flexible Payment Allocations

- Platform as a Services (PaaS)

- Payroll Fintechs

- Non-finance Companies Offering Fintechs

- User Experience Optimisation