Branchless Banks are Taking Over Europe

Before starting to deep dive into branchless banks, let’s see the banking revolutions first. For more than a decade, banking has been undergoing a constant transformation. Now, when we hear the word “bank,” we no longer picture a physical branch filled with workers and computers. We think of a simple application. This is especially true of the younger generations of users.

The starting point of this transformation dates as far back as 2008, to the global banking crisis and the UK’s answer to getting its most durable industry back on track. With challenger banks joining the game, the world began to see a new approach to banking. In turn, challenger banks entering the arena accelerated the development of financial technologies, which opened a window for FinTechs to emerge and, in some cases, to even become as powerful as banks. Today, when we look at the most influential banks in the Eurozone, we see FinTechs from that time that went on growing by getting digital banking licenses. N26, Revolut, Monzo, Tide, and Starling Bank are a few of the shining stars of this new way of banking, and with open-banking regulations becoming widespread globally, we’ll soon witness even more new companies joining the banking industry.

Source: Televisory

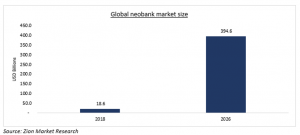

Televisory’s report on the unstoppable rise of digital banks shows us that the market is expected to rise as much as $394,6 billion in five years. Until the pandemic, FinTechs and neobanks were the new favourite investment arena, but, like every other sector, the pandemic had a slowing effect on investment.

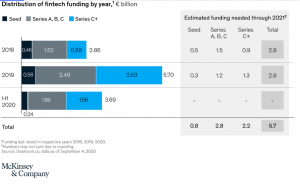

Source: McKinsey & Company

Yes, the pandemic may have slowed down the venture capital funding for FinTechs and digital banks, but McKinsey & Company’s advisory report on the matter reveals that the industry will go back to normal sooner than almost everything else. In an atmosphere of approximately 11% economic contraction in European countries, we can safely say that digital banks are the lucky members of the financial sector.

Digital Banks are Going Nowhere, and More Countries are Stepping In

There is no doubt that FinTechs and digital banks are in constant growth. In 2019, 24 financial services start-ups hit a valuation of more than $1 billion, a considerable amount of which have already gotten their digital banking licenses. New digital banks like Orange Bank, our client Vive Bank, and, most popular of all, Revolut, are the first that come to mind. Many countries in the European Union have made it extremely easy to apply for a digital banking license after PSD2 regulations, and Eastern Europe is joining the game now as well.

Branchless Banks Next Stop: Turkey

As the hub for financial technologies in Eurasia, Turkey seems to be the next player to accelerate the digital banking revolution in the area. Especially with younger generations joining the economic system, the country has seen a boom in FinTech investment and usage. According to BKM’s report, 31% of the young population (19 million) is unbanked in the country and FinTechs are filling a huge part of the gap. Two of our clients – Vodafone Pay and Paycell, with more than 4.5 million users – have increased investment in their mobile financial services to meet the ever-rising demand for new-age financial services. Other players, like Ininal which has reached 4 million users, and Papara with more than 7 million users, are continuing their growth at full pace.

According to Bloomberg Turkey, the Banking Regulation and Supervision Agency of Turkey has begun working on launching new regulations that will let digital-only banks emerge. Considering the more than 15 million active non-banked FinTech users in the country, a new wave of change for the area is right around the corner.

Join the Digital Banking Revolution with Tmob

“Times are changing” may be one of the most popular cliche phrases of the last century, but it’s becoming more true every day! Only a couple of years ago, it was almost impossible in most European countries to gain a digital banking license. Today, many of the continent’s game-changing financial institutions are FinTechs, or neobanks that used to be FinTechs. Speaking as a software company that focuses on financial technologies, we can safely say that the transformation is going to be even quicker in the future, and we are here to help.

Here at Thinksmobility, we have been developing platforms for years. Our clients include conventional banks, branchless banks, telecommunication companies that offer mobile financial solutions, and more. In this article, we have mentioned many successful FinTech and digital banking start-ups, a majority of which outsource their technological needs to keep up with the pace of modern development. To see how you can adapt to the new age of finances with an upper hand by outsourcing technology, read our blog post.