How Millennials and Gen Z are Shaping the Future of Payments

Once again, we’re talking about one of the most popular topics of the last century: the generations that the majority loves to hate. You’re in luck, as we’re not here to add fuel to the fire. Instead, we will dive deep into how Gen Z and millennials are shaping the future of payments with their highly-disruptive nature.

Although there are many regional differences in the financial behaviours of GenZ’ers and millennials, almost everyone agrees that the future of payments & banking is mobile, and banks may not be as welcome as they used to be.

Payment Choices of Younger Generations are Not What It Used to Be

Banks may have survived millennials becoming powerful players in the economy with their conventional ways, but statistics show us that banks need to get it together in terms of user experience and personalisation to get a place in the daily lives of Gen Z’ers. Especially if we’re talking about the future of payment technologies, they have long lost their crown to more convenient, simpler payment tools like PayPal.

In a research conducted with 3000 applicants in the middle & western Europe, 77% of millennials stated that they have a PayPal account, and they don’t hesitate to use it in P2P money transfers. On the other hand, debit cards and credit cards are still the prior payment methods for millennials when it comes to in-store payments.

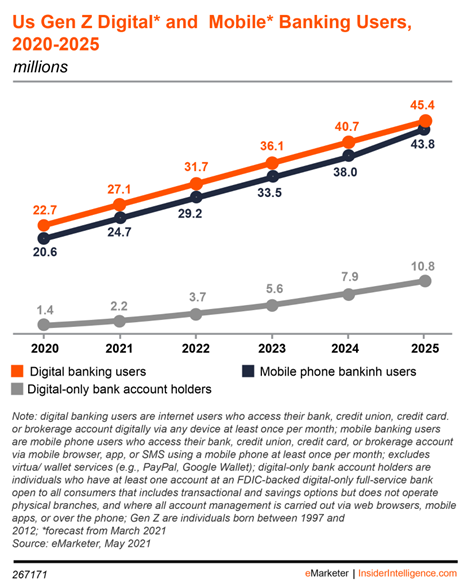

Image Source: Insider Intelligence

Insider Intelligence estimates that one-in-four financially-active Gen Z’ers in the US will rely on digital banks in the next five years, and the majority of them will use mobile apps to do everything financially.

The future of payments is shaping around new technologies, instead of banks, and the merchants agree. According to the merchant report by The Paypers, four main keywords are the main forces behind the shift to new-age technologies: user experience, personalisation, convenience, and financial freedom.

User Experience: What Difference Does It Make?

Mobile payments are becoming more and more popular as a way to pay for goods and services. But what makes them so popular? Is it convenience? Is it the fact that they can be used anywhere? The answer is both, but there’s something else that’s even more important: user experience.

Millennials, Gen Z, and even older generations are all using mobile payment tools because they provide a better user experience than any other payment method out there. User-friendly interfaces, easy accessibility in stores, and the ability to use them without cash or cards make mobile payments seem like a no-brainer for anyone who wants to make a purchase or a transaction.

The importance of user experience cannot be overstated in this day and age where people have so many options on how to pay for things with their phone – cashless transactions are becoming more and more popular by the day, and as the younger generations join the ecosystem, the experience becomes more and more essential.

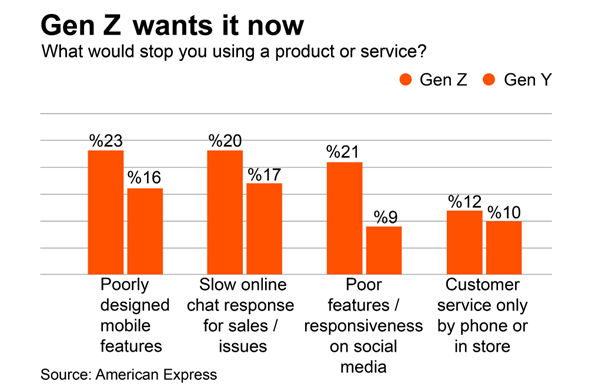

Image Source: American Banker

The study by American Express once again highlights the importance of a seamless user experience in financial services. While 16% of millennials have stated that they will stop using a service after experiencing poorly designed mobile features, the number increases to 23% in Gen Z’ers.

Cryptocurrency: Is It Here to Stay?

Crypto wallets are yet another example of the disruptive nature of younger generations. If we were to answer the question of cryptocurrencies’ stability last year, we’d probably be on the more positive side. But today, the concept is not so popular. Still, younger generations will not give up investing in assets, new-age currencies, and tokens—the keyword is financial freedom.

To meet the demands of younger generations, a crypto wallet integration is nice-to-have, but that’s not all. In order to create more seamless payment experiences, financial institutions & service providers should be open to third-party integrations. Marketplace banking seems like the new path the industry is taking, and on paper, it looks more bulletproof than a simple crypto wallet.

The Decline of Cash: Who Needs It, Anyway?

A cashless economy has been in the making for years. Especially during the pandemic, we’ve seen a huge decline in cash, making western economies shaft their ways to the cashless payment methods—which had already been adopted by the far east.

It’s clear that younger generations prefer mobile payment methods over cash payments. And although banks are not their go-to choices when it comes to finances, they still expect banks to offer more convenient mobile payment ecosystems.

More than half of European Gen Z’ers prefer going cashless. Even in the regions like Germany where physical cash is still the number one payment option, the rates are unexpectedly increasing—all thanks to neobanks and fintechs like N26.

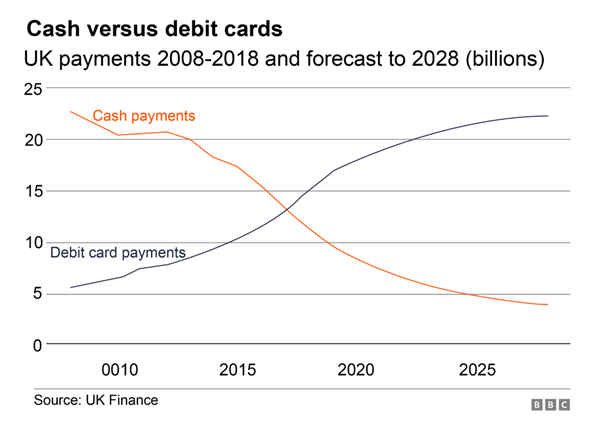

Image Source: BBC

In the UK, debit cards have already taken the crown over cash payments, and that was thanks to Gen X and millennials. With Gen Z’ers joining the oicture, it’s only a matter of time when mobile payments take over debit cards.

Services within Services

Today, a financial servie is not only a financial service—at least, it shouldn’t be. The age of super apps is about to begin in the western world, and it’s all about integrations. Accordingly, banks, fintechs, and even e-commerce giants are seeking new ways to create seamless, connected services between different areas.

The super apps of China didn’t used to look like fitting solutions for the western world, but the obsession with growth makes the model inevitable. In the end, the model of “all-services-in-one-place” is being spoken about by multi-billionaires like Elon Musk. And it’s no secret that he’s not alone on creating the super app, whether it’s called the X app or Y.

Join the Future of Payments with Tmob

When we look at the way payment technologies and the quick adoption of new payment technologies, we see that the younger generation will make things more disrupted and connected at the same time. After so much disruption, we needed a twist! As a SaaS and PaaS powerhouse that focuses on e-banking, financial technology, e-wallets, e-commerce, and user experience, we can clearly see that the future of payment will be connected, and we’re developing our platforms accordingly.

Our two main financial solution platforms, Future-Ready Fintech Solutions Platform and Mobile Financial Services Platform focus on customisation. In short, what our client needs, they get it. With our platforms, you can create a path for the future of payments whether for an e-commerce platform, a fintech, or a bank, even. Contact us to see what we can offer.

Sources: https://www.reply.com/en/industries/financial-services/european-millennials-and-their-relationship-with-payment-systems https://www.insiderintelligence.com/content/us-generation-z-financial-behaviors https://www.americanbanker.com/payments/opinion/to-serve-gen-z-banks-must-collaborate-with-payment-fintechs https://www.bbc.co.uk/news/business-48544695 https://www.bbc.com/news/world-asia-63113517