Solid Ground: The Steady Rise of Mobile Financial Technologies in the U.K.

It’s 2021 and, now, everybody is aware of the fact that the money of the future is not going to resemble the cash of the last centuries. Like everything else on the planet, money is going mobile, and we have been seeing different adoption models in various markets around the world. For a couple of months, we have been focusing on various regions and their adoption of mobile money. First, we have dug into the European leader, Germany, and its mobile-focused financial future. Then, we have visited where it all began: Sub-Saharan Africa. Now, we have one of the early adopters, the U.K.

Mobile Money is Growing at a Steady Pace in the U.K.

The U.K. has always been a pioneer in money management, but the country’s approach to mobile payment methods has not been as dramatic as that of the developing world. The reason lies within this sentence; the country sets the trends in banking, and therefore the reach of its financial institutions has always been incomparably wide compared to the rest of the world. Still, the population embraced mobile payment systems long before the rest of the world, but here, there has been a completely different story. The U.K.’s giant financial institutions have been offering mobile payment options to their customers longer than everyone else, and when 3G networks became mainstream, people began using their smartphones instead of their wallets. According to Monitise and the Future Foundation’s 2011 survey, almost 10% of the country’s population preferred mobile devices for financial purposes. When we compare the mobile money usage of the U.K. with the rest of the world, we can safely say that the Brits did it before it was cool.

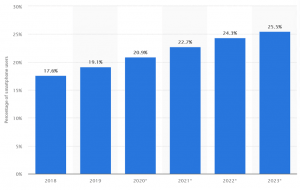

Share of smartphone users who make proximity mobile payments in the United Kingdom (UK) in 2018 and 2019, with forecasts from 2020 to 2023

Source: Statista

As this chart shows, mobile payment usage in the U.K. is rising at a steady pace. Unlike many other countries, there are no surprises here. The biggest boom in mobile payment adoption was recorded in 2011 with a 50% rise, and after that, growth continued at a slower pace. Still, when we look at the most successful fintech startups, we see many British companies. With the country’s progressive open banking leap, this is only natural.

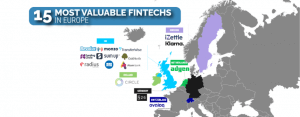

The Cradle of Finance Births Many Fintech Apps

The U.K. has always been a pioneer in terms of banking and paving the way for the financial industry. Compared to other European countries, the British population has a higher trust in financial institutions at 55%. This is compared to 43% in Germany and 37% in Italy. The number may be lower than you might have expected, but still, it stands at a point that is just enough to make people invest in fintech startups. For the last decade, Europe has seen a boom in fintech investment, and if we look at the most successful fintech services, we see many U.K.-based companies.

Source: Fintech News

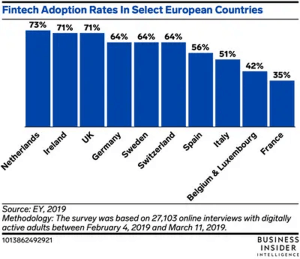

Globally-recognized fintech companies like BGL, Revolut, and OakNorth were all born in the U.K., which made the British population natural fintech users. According to EY’s 2019 report, 71% of digitally active adults in the U.K. stated that they have used a fintech application.

Source: Business Insider

With open banking becoming the new normal, we can only expect a dramatic rise in the near future. In a country where banks are still credible financial institutions, the rise of fintech may take on a new pace soon. You can read our article on the perfect relationship between fintech companies and open banking here.

The Future of Money is Mobile

There is no doubt that sooner or later the world is going to embrace mobile money. For a decade, we have been on the verge of the money revolution with cryptocurrencies and open banking. Evidently, almost every brand, big or small, is getting into the mobile money market. Although the adoption rates seem low in the U.K., growth is steady, and for a country with a 67 million population, 20% is pretty good. Even better, the market is constantly growing and so is demand. With our MFS platform, it is easier than ever to build an MFS platform. To learn what you can do with our customizable and ready-made platform, visit our page.