The Rise Of Mobile Wallets

No one could have imagined that one day we would use our phones to take photos, watch TV shows, monitor our health, or even turn on the lights. However, thanks to developing technology, we are now far ahead of taking photos and watching TV shows on our phones! With the latest technology, we can now replace our physical cards and bank cards with mobile wallets.

According to a new study by Juniper Research, approximately 2.1 billion consumers worldwide used a mobile wallet to make payments or send money in 2019 alone. According to a report by Zion Market Research, by the end of 2022, the global mobile wallet market will be worth over $3 billion! That’s a huge number for a relatively new trend!

What Are Mobile Wallets?

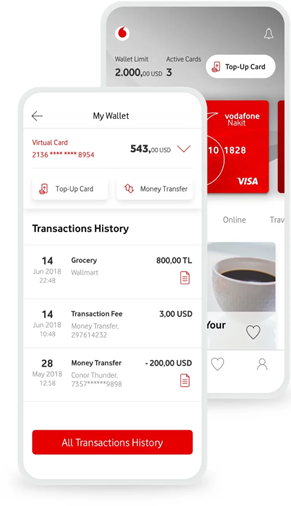

A mobile wallet, also known as a digital wallet, is basically a mobile application that allows you to store cash and pay without a physical credit card or online banking. Users can carry all debit and credit cards belonging to different banks and payment institutions in the mobile wallet and can also make their payments with mobile money.

Mobile wallets are becoming an increasingly popular way for people to pay for goods and services, both online and offline. Users first register their payment details with the digital wallet provider. After that, when people make payments to merchants that accept that wallet, their transactions are done in one click.

What Are the Different Types of Mobile Wallets?

Information stored in mobile wallets is always encrypted. This prevents cybercriminals from carrying out fraudulent activities with mobile wallets. While physical cards can be stolen or duplicated, mobile wallets are very difficult to steal because e-wallets come with encrypted keys that do not reveal any private information.

There are different types of mobile wallets for users to use mobile cards in various areas. These mobile wallet types are as follows:

- Open Mobile Wallets: Open mobile wallets are types of wallets used directly by a bank or through a third party. Open mobile wallets allow customers to use the funds in their mobile wallets to make transaction payments or withdraw cash. Open mobile wallets also allow users to pay for in-store and online purchases.

- Closed Mobile Wallets: Closed mobile wallets are linked to specific merchants. In this variant of wallet, users can use the funds in their wallets to pay only for transactions initiated with a particular merchant. In closed mobile wallets, users cannot use the money to pay for transactions with other merchants and third-party service providers.

- Semi-Closed Mobile Wallets: Semi-closed mobile wallets allow users to use the funds in the wallet to pay for transactions with multiple merchants, as long as there is an existing contract between the merchant and the mobile wallet company. Also in semi-closed mobile wallets, users can withdraw funds to a bank account, but users cannot withdraw these funds in cash.

Thanks to the frequency at which people are already using their mobile devices, digital wallets have become a natural extension of the phone’s functionalities. People use digital wallets because it’s faster and more convenient than any other payment method, be it a credit card, debit card, or cash. With just one tap or click, people can make a payment and move on with their day.

Mobile Wallets by Operating Systems

A few mobile wallets launched by operating systems, such as Apple Pay, Samsung Pay, and Android Pay, have already gained widespread popularity across the globe. These mobile wallets gave people their first taste of storing multiple bank cards and making more secure payments, all within a single device.

Brand-Specific Mobile Wallets

We’re now even seeing brand-specific mobile wallets on the rise, including Walmart Pay and the Starbucks wallet app. In addition, social media apps have begun adding peer-to-peer money transfer (P2P) options, such as Facebook Payments and WeChat Wallet. Friends can now transfer money to one another in the same time it takes to send a text message, even if they don’t belong to the same bank.

Mobile wallets make it easy for users to shop anywhere. With mobile wallets, users do not have to take out their wallets for a card and can quickly shop online without having to provide payment information. In addition, mobile wallets and mobile wallet companies can communicate with customers and users. For example, mobile wallets can inform users when a coupon will expire.

Some mobile wallets may differ depending on the type of smartphone the user has, but there are also universal options for all types of mobile devices. These options are as follows:

- Card-Based Mobile Wallets: Card-based mobile wallets, which generally accept card payments, use physical payment options combined with contactless NFC technology payments. Card-based mobile wallets are increasingly adding faster payment functionality to merchants so that users can use their stored payments and personal information.

- Mobile Wallets with Stored Value: Mobile wallets with stored value can be financed directly from a bank account or other methods, including cash, lump sums, and P2P payments. Stored-value mobile wallets also allow users to transmit digital money and convert digital money into banknotes when necessary.

Are Mobile Wallets Safe to Use?

Are Mobile Wallets Safe to Use?

In short, yes. While there were initially consumer concerns about data breaches and other security issues, mobile wallets have now been embraced by major smartphone manufacturers, which incorporate secure technology directly into the hardware. Although there is still a lack of trust in card payment systems of banks, online shopping, and even ATMs today, some of the mobile wallet companies that serve the user are the initiatives of the banks. These companies, which are authorised by certain institutions, provide a secure mobile wallet experience for users.

This means all mobile wallets are under the protection of strong encryption algorithms and people’s financial information is hidden from merchants and other third parties.

Digital wallets use multiple levels of encryption and tokenisation to ensure your banking information stays secure. Tokenisation is an advanced security measure that reduces credit card fraud by replacing your bank card details with a randomly generated string of numbers (known as a “token”) so that the true data remains hidden. For this reason, mobile wallets are extremely safe if used correctly. Before using mobile wallets, first of all, it should be ensured that mobile wallet service is obtained from an approved and authorised brand that has obtained the necessary permissions. In addition, since the payments are completed without a password, it is necessary to use it carefully on computers and phones that can access the wallet.

Mobile phones have their own security set-up as well, which often requires a PIN code or biometric authentication before allowing access to the device. Biometric authentication is a particularly strong form of security as it uses a person’s physical features to secure their personal information, such as fingerprints or facial scans.

Will Mobile Wallets Overtake Plastic?

Mobile payments are expected to increase exponentially in the coming years due to the steady increase of people owning and using their smartphones. Particularly with companies now coming on board to develop brand-specific digital wallets for users, more services and conveniences will be seamlessly added to people’s lives. In fact, thanks to digital wallets, we’re now living in a time where you can safely pay for your coffee before you even arrive at Starbucks and then skip the long line to pick it up.

The digital wallet is the 21st century’s answer to credit card payments and will most likely displace all other forms of payment, including cash, over time. And, why not? Because digital payments have gone well beyond the typical interactions found between merchant and consumer. For example, peer-to-peer money transfers via mobile messaging have brought a social twist to payments. Partners or friends can now seamlessly transfer money to each other using debit or credit cards, even if they don’t belong to the same bank. In short, this regulation of monetary interactions is reflected in the natural progression of digital payments.

Mobile wallets provide a simple and convenient way to manage payments, banking information, and loyalty programs with brands–and you can leave the bulky cash and plastic cards at home. Sounds like a win-win situation to us.

What Are the Advantages of Using a Mobile Wallet for E-Commerce?

In e-commerce, it is important for the customer that shopping sites use services within the alternative payment system. Online shoppers want to complete their transactions very quickly and easily. Wallet accounts make this possible. An e-commerce site is preferred by many users if it accepts payments from mobile wallets.

This situation also has a security dimension. Under normal circumstances, card details entered in forms on e-commerce sites cannot be viewed by the shopping site, but consumers may still feel uneasy about this issue and hesitate to enter their card details on the site. Thanks to mobile wallets, there is no need to provide card details to the e-commerce site. This makes the e-commerce site that accepts payments with a mobile wallet safer in the eyes of the consumer. In addition, users can benefit from Tmob and MFS platforms and securely use their mobile wallets.