Challenger Banking 2.0: Branchless Banks are Here to Challenge the Big Four in the UK

The new millennium brought with it many revolutions. Looking back twenty years from today, we see a whole new climate in every area. One of the most popular words of this millennium, digitalization, is transforming everything and, finally, it is here to change one of the last standing castles of the previous millennium: banking. While talking about a financial revolution, the United Kingdom is the first place to come to mind. Challenger Banking 2.0: Branchless Banks are Here to Challenge the Big Four in the UK

Challenger Banking 2.0: Branchless Banks are Thriving in the UK

The UK financial system had been based on four big financial institutions: The Royal Bank of Scotland/NatWest, Barclays, HSBC, and Lloyds. In 2008, during the economic recession, the country passed new regulations that led new players to join the game, and honestly, the first newcomers were not that challenging. Today, however, when we look at the most successful challenger banks in the country, we see Monzo and Revolut, both of which are fully digital.

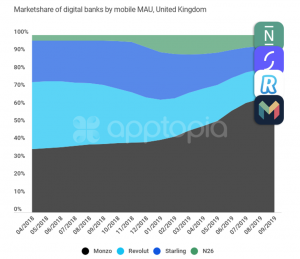

Source: Apptopia

Apptopia’s article on the market share of mobile banks states that all leading online banks are growing, even though Monzo is taking the big bite. Revolut and N26 were two of the early players, but Monzo’s futuristic approach seems to be working. With the new regulations that came with challenger banking, experts predict an even more exciting climate for online financial institutions and fintech start-ups in the future.

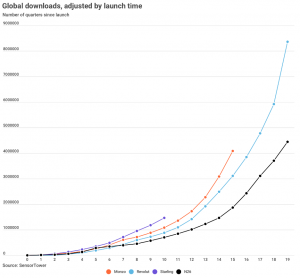

Source: Sifted

Sifted’s chart from 2019 shows the exciting rise in the market share of digital banks, and looking at the tech-driven habits of the new generations, it is safe to say that this trend will only continue.

Younger Generations Don’t Need Branches; Convenience is Enough

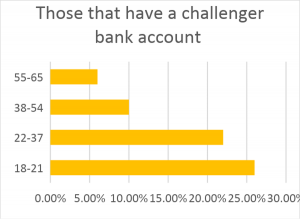

The time has finally come that millennials have become the majority in the workforce, which inevitably put them in the most valuable position for financial institutions. Now, even Gen-Z’ers are joining the workforce. According to Finance Derivative’s survey, one in every four millennials and Gen-Z’er in the UK are challenger bank customers, and most of them perform all of their needs online and mobile.

Source: Finance Derivative

With the liberties that will come with open banking, money is going to become an easier-to-operate meta in not only younger user’s lives, but everybody’s. In short, digital banks are making life easier for everyone, and the future is even brighter for the visionaries.

Mobile Banks Make Banking Easy for Users, and We Make It Easier for Banks

There is no doubt that mobile banking has already become mainstream in the UK. Conventional financial institutions are also aware of that fact, which makes them seek new ways for closing branches and investing in mobile operating. Today, customers can even get loans within seconds, without filling out pages of paperwork. In short, if there is an area more competitive than banking in the financial arena, it is mobile banking, and we are here to help.

Here at Thinksmobility, we build mobile banking systems that work flawlessly, so nobody else has to. One of our clients in the area, Vive Bank, is one of the latest branchless banks in the UK who has built a unified customer experience on our E-Banking Platform. Every new digital bank in the UK is offering something unique, and Vive has built its strategy on security, customer satisfaction, and easy loans. You can read more about our client here.

The e-banking platform is one of our latest products, and we have designed it using our experience and know-how in mobile financial solutions and e-wallet platforms. With our e-banking platform, you can begin your journey in the future of the finance sector or evolve your existing business.

Thinks Mobility E-Banking Platform is Always Ahead of Its Time

As we have mentioned, financial technologies are our passion. With clients from various branches, such as conventional banking, digital baking, and telecommunication companies who invest in mobile money management apps, we always keep our platforms ahead of time. Here’s what our e-banking platform offers on day one:

Fully functioning digital bank branches

With the Thinks Mobility e-banking platform, customers can transfer, pay, and build savings in digital accounts with cost savings. With our latest version, they can even apply for loans!

100% secure

One of the biggest concerns in banking is undoubtedly security. Building a digital operation that has no security flaws requires months of testing. Since our e-banking platform has been used by many clients, we can guarantee full security.

Open banking features

Thanks to open banking, banks and other financial institutions will be able to serve their customers better. If the transition seems too difficult, we’ve got you covered. We are always updating our platform with the latest open banking developments.

To learn more about our e-banking platform, visit our page or book a meeting with a Thinksmobility expert to see how we can help evolve your business.