Challenger Banking: What Is It, and Does It Live Up to Its Name?

The UK has always been the center of conventional banking, and this is not a coincidence. Until recently, it was nearly impossible to compete with decades- and even centuries-old established banks. With the global economic crisis in 2008, the country decided to ease the process for newcomers in the financial competition. After that, the whole banking system has entered a new path called challenger banking; first in the UK, and then on a global scale.

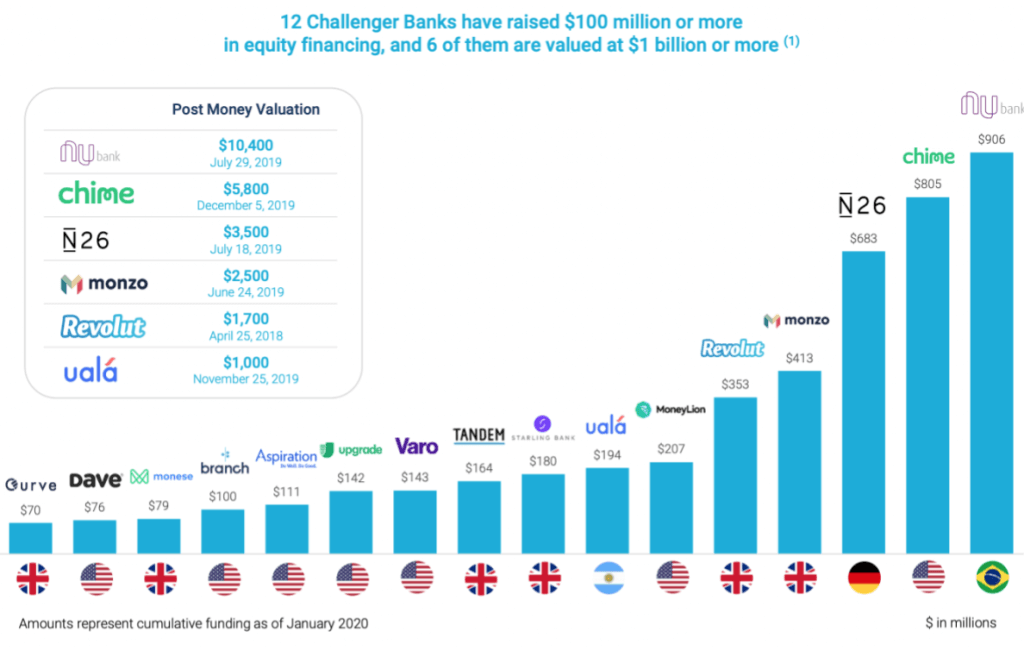

Source: FinTechNews.ch

What is Challenger Banking?

Challenger banking is a term usually used to describe a type of banking that was created to offer traditional bank services in a much more convenient way. They do this by providing innovative solutions to customers who need mobile or online solutions for their needs. As these types of banks grow in popularity, they have been able to provide convenience and affordability for many people who need them.

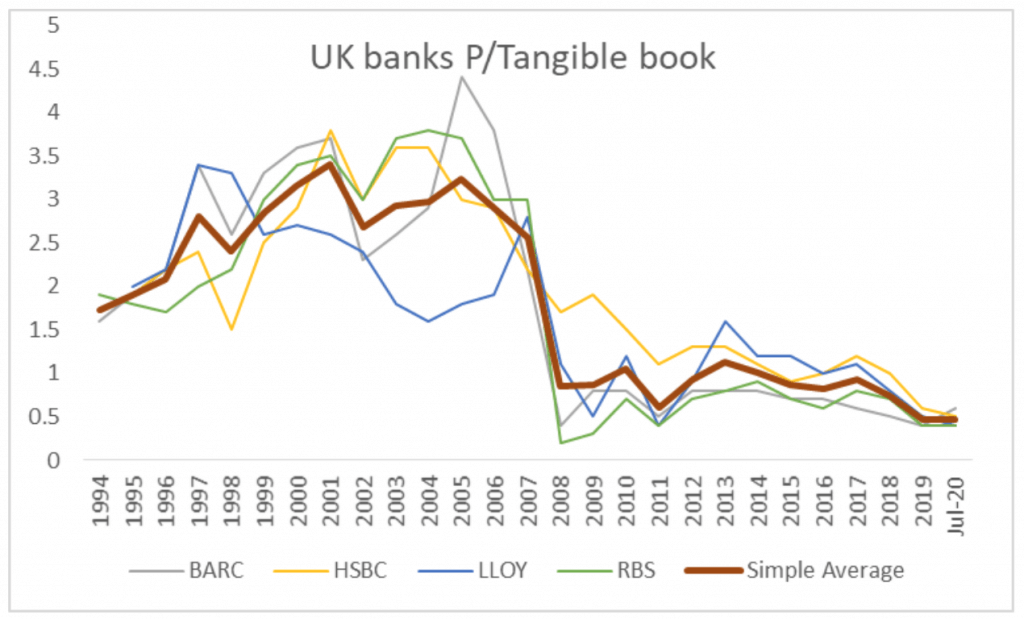

The story began with the new banking regulations by the UK government that let new players get into the banking arena. The newcomers were named ‘challenger banks’ and, with their new financial technologies and the approaches that fit the needs of the modern-age customer, they actually began challenging the conventional banking system and its rulers. Even in a world where the established banks have proven themselves as trustworthy and secure institutions, challenger banks still managed to thrive, and they thrived so much that the big four couldn’t get back on their feet in terms of stock value.

Source: SharePad

The first challenger bank was established in 2010 in the UK, and even with the new regulations, it wasn’t all fun and games for Metro Bank. After all, we are talking about an economy where for more than a hundred years, there weren’t any slots for a fifth bank in the reign of “the big four”.

After the bold move of Metro Bank, we’ve seen a more colourful banking scene in the UK, which turned the country into a financial revolution hub once again. A couple of years later, a real banking revolution came to life with the emergence of all-digital banks.

New Stop In Banking: Open Banking

With open banking becoming the new norm globally, it seems like the whole world is going to embrace the new-age approach to banking and finances. The growth projections of the challenger banks are pretty exciting, too. According to Globenewswire, the challenger bank industry was valued at $20.4 billion in 2019, and its market size is projected to reach $471.0 billion globally by 2027.

In the US, it was reported that seven big challenger banks have collectively recorded a user growth of 39% — from 28 million customers to 39 million — between 2019 and 2020. In the UK, where challenger banks and neobanks are taking a bigger part in the financial arena, the numbers are excitingly increasing, too. FinExtra’s article reveals that 27% of the British population used a digital-only account in 2020, compared to 23% in the previous year.

Yes, it seems like the giants of the financial arena are facing a challenging decade. So, what makes challenger banking stand out in a conservative environment?

Challenger Banks Address the New Generation Who Perceive Money in a Different Way

While the older generations see decades-old banks and financial institutions as secure and trustworthy, millennials and Gen-Z see them as the source of the problem. The same rule applies to almost every industry for the younger generations; they want what’s new, cutting-edge, sustainable, and comfortable. According to Swell Investing, 84% of Gen Z investors are either already investing in socially responsible investments or plan to invest this way in the future. Nearly 31% of Gen-Z investors are willing to allocate 50% or more of their investment portfolio to impact investments, and one in four millennials would do the same.

When we look at the path challenger banks are taking, we see a perfect fit for the younger generations’ financial demands. Instead of opening new branches on every corner, challenger banks choose a digital approach. This way, they can up their customer service game while using less budget and, for a generation that needs open communication, that’s more important than an ad in Times Square.

You can expect to see a new form of challenger bank that will speak to the needs of a particular persona, but if we need to classify the new forms of banking that are challenging the giants, here they are:

All-Digital Banks

The fastest-growing trend in the banking industry is undoubtedly the branchless banking model. Thanks to today’s financial technologies, we see many start-up banks. One of our beloved clients, Vive Bank in the UK, is a perfect example of the branchless model. The bank has no branches, yet it stands out with its fast and effective consulting service, open banking features, and ever-evolving features that can be carried out 100% digitally.

Until last year, the industry was talking about the advantages of going branchless, but today, with the effects of the pandemic, even ATMs seem like things from the past. Money is changing its form faster than expected and, soon, e-money will rule the world. In the end, this is a great opportunity for digital banks.

Vive Bank uses our e-banking platform that offers a secure, up-to-date, and unified experience for both customers and banks.

FinTechs Getting Bank Licence

In a world where digital banks are rapidly disrupting the financial sector, many banks are scrambling to alter their strategies and models. The latest entrant in the market is Revolut, a digital-only bank that aims to offer a wider range of services at a much lower cost.

One of the core services that Revolut provides is that it offers cards that can be delivered instantly and can be used in 200 countries without any added fees. These features not only make it an attractive choice for people who travel frequently but also give even more flexibility and control in terms of expenditure.

Commercial Lenders

While the majority of the challenging banks embrace a highly digital approach, some newcomers prefer to stand out with their convenient loan plans. In the UK, Shawbrook Bank and One Savings Banks are the perfect cases for commercial lenders.

Brick-and-Mortar Challengers

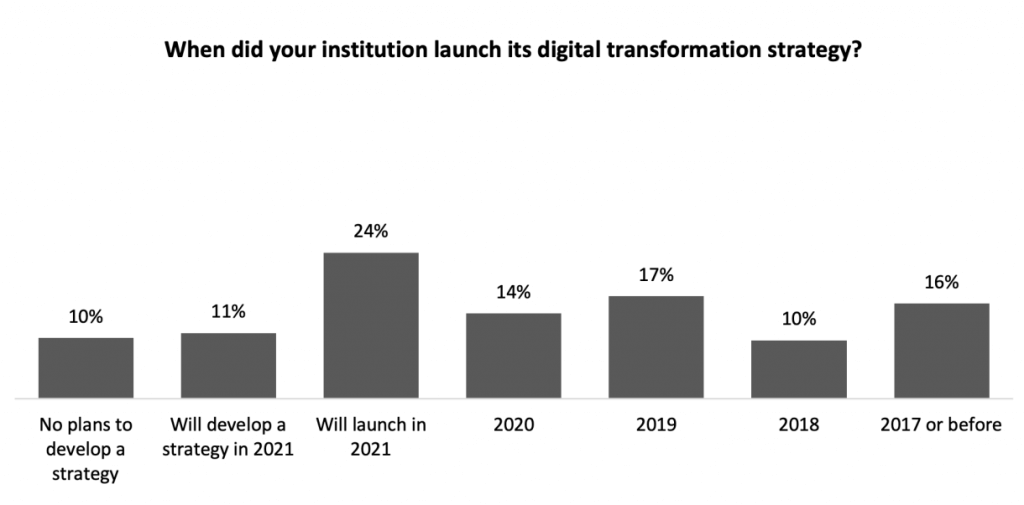

When the country opened up space for newcomers in 2008, not everybody went the digital way. New institutions like Virgin Money and Metro Bank preferred to go the conventional way. Still, they managed to become reasonable alternatives for many people. Although they were called ‘challengers’, in today’s market, they have joined the challenged group. But of course, in order to stick around, brick-and-mortar financial institutions are aiming for a more digital future. Still, looking at the numbers, conventional banks have a long, long way to adopt the new-age financial services.

Source: Cornerstone Advisors

Thankfully for the brick and mortar banks, it’s still not too late to join the new age, since developing new technologies and adopting them doesn’t take as long as it used to. Here at Tmob, we’ve got ready-made digital banking solutions that can be customized liberally with the considerations of the needs of all kinds of financial institutions.

Join the Next Generation of Banking With Tmob’s Latest Technology

There are many forces that mean open banking could finally be the new approach, and challenger banks are one of the accelerators. In order to compete with the rise of digital banks, every bank, giant and newcomer alike, is trying to take advantage of digital tools and open banking. Luckily, it is easier than ever to adapt to the newer systems with ready-made and customisable tools like ours. Here at Tmob, we have the vital tools for every financial institute or start-up ready. Our highly-customisable platforms and modules include e-banking, mobile financial solutions platform, and e-wallet. With industry-leading clients and more than a decade of know-how, every financial institution can adapt to open banking smoothly with the latest digital tools to offer the best experience. To learn more, you can book a meeting with a Thinksmobility expert by filling out the form.

Who are We?

Tmob | Thinks Mobility is a global technology powerhouse, specialized in digitalization and integration solutions, bringing growth and success to businesses and partners with its innovative SaaS, PaaS, and premium solutions since 2009 with Tmob Turkiye (TR) and Tmob United Kingdom (UK) headquarters.

Sources: 1New Report Sheds Light on Booming Challenger Bank Market | Fintech Schweiz Digital Finance News – FintechNewsCH 2https://knowledge.sharescope.co.uk/2020/08/13/uk-banks-in-the-eye-of-the-storm/ 3Global Neo and Challenger Bank Market (2020 to 2027) - by Service Type and End-user (globenewswire.com) 4https://www.finextra.com/newsarticle/37277/uk-and-us-digital-challengers-see-strong-growth-in-2020 5What Millennials and Gen-Zers want from Banks (tcs.com) 6Meet Vive, a New-age Banking System with Tmob's Open Banking Infrastructure - Tmob - thinksmobility 7E-Banking - Tmob - thinksmobility 8https://hs.crnrstone.com/banking-2021 9The Increasing Power of Open Banking - Tmob - thinksmobility