FinTech is the New Normal: Predictions and Trends for the Future of Financial Technologies.

It’s been a wild decade for FinTech companies. Thinking about the situation the financial market is in now, we can see a wonderful mess, and even those who took the rise of FinTech start-ups for granted are now investing in the area. We can even boldly say that, while the FinTech start-ups of the last decade were trying to find new solutions for financial services where banks were falling short, it’s the other way around today. With open banking becoming available almost everywhere last year, we can expect an even more challenging climate for the future of financial technologies.

Last year, we shared some of the top predictions about the future of financial technologies. Almost a year later, we can see some new and exciting fintech trends, and in this article, we are going to share our favorites.

Artificial Intelligence Replaces Advisors

It’s 2021, and robots are everywhere! The best part is, they are still nowhere near being the source of a dystopian disaster. Of course, when we say robots, we mean artificial intelligence. Today, AI is one of the most talented helpers of human life, and step by step, it is taking hold in the FinTech world. Some of the “trendy” financial institutions like Abe, N26, and Monzo have already begun using the power of AI to get to know their customers and give the best financial advice. For now, artificial intelligence cannot replace the best banking advisors, but we have seen how quickly AI learning happens in many different scenarios before. Still, AI helps automate many workloads and saves financial institutions from an unnecessary workforce, especially digital banks.

Mobile Wallets and Mobile Financial Services are Booming

The meaning of cash is more abstract every day, and the strongest driving force behind the transition is fintech. Like almost everything else on the planet, wallets are getting the “e-” prefix. Mobile wallets or e-wallets are undoubtedly more convenient for the end-user than carrying actual cash and, of course, the digital revolution has advantages for banks and other financial institutions as well. Expecting a digital transformation from financial institutions is not an exciting story here; the new brands stepping into the financial game are. First, market giants like Amazon, Google, and Apple joined the e-wallet and e-money game, then came the telecommunication companies who literally became the financial saviors of the developing world. Now, we are witnessing the next step: every brand is launching its own version of a mobile wallet, and claiming its share of the financial transaction market. For medium- and large-sized companies, the benefits of launching a financial app are limitless, and since it is easier than ever to launch an MFS or a basic fintech app, we are going to be seeing more and more brands joining the arena. To learn more about the benefits of launching a fintech application, you can read our article.

Conventional Banking is Going All-Digital

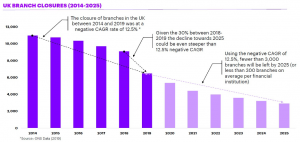

We have been seeing a digital transition in conventional financial institutes but, especially after COVID-19, many banks have fallen behind in moving their operations online. ONS Data’s bank branch closure predictions for the next five years states that more than half of the branches in the UK will be closing, and the chart was made before the pandemic began.

Source: Accenture

Access Softek’s survey from July 2020 reveals that 49% of the customers already rarely visited a bank branch, and 27% of those who do are expecting a decrease in bank branches.

Plus, branchless bank start-ups began offering exactly what the giants had been. For example, our e-banking client Vive Bank is taking advantage of the open banking features by offering full transparency and even giving fixed-rate loans to its customers. The best news is for start-ups! With ready-made and up-to-date platforms like ours, anybody who is brave enough to step into the fintech game can achieve their goals without spending months building a platform. To learn what our e-banking platform offers, visit our page.

Security is No Longer a Concern

One of the main reasons customers, especially the older generation, don’t choose fintech services is security concerns. Yes, banks are still the most secure financial institutions for the majority of the global population, but with open banking more widely available than ever, fintech applications are coming under greater supervision. On top of that, other security-centric technologies are being adapted for use with fintech applications every day. With newer technologies becoming available for the end-user, biometric security systems seem to be the next step for fintech companies to gain people’s trust.

Compared with the last decade, financial technologies will likely be even more popular in the coming years. To be part of the future of financial technologies with as little effort as possible, check out our fintech products at thinksmobility.com. To learn more, you can book a meeting with an expert by filling in the form here.