The State of Cash in the Post-Pandemic World

It’s been more than a year since the pandemic came into our lives and when we try to remember the world before, it feels like a decade has gone by. Yes, it has probably been the most boring and mentally challenging period of our lives, but another factor of this illusion is the immense impact that a sneaky, little virus has had on the daily life of the average human being.

The pandemic has changed many aspects of our lives, and if there is one thing that everyone on the planet has a love/hate relationship with and that transformed with the pandemic, it’s cash. The digital transformation of money has long been expected, but nobody had imagined the whole globe would go cashless so soon. The pandemic evolved the state of cash as we know, and it seems like we’ll see a more advanced version of this transformation afterlife goes back to normal, hopefully, sooner rather than later.

How Cash Became Digital During the Pandemic

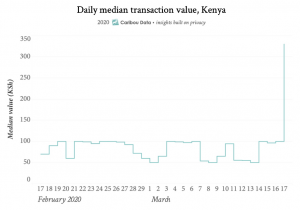

Remember the first days of the pandemic? The toilet paper and pasta hoarders, the boom in face mask prices, and the sourdough craze were not all that was going on. Looking at the chart below, you can see how the pandemic has affected daily median transactions in only one day. These numbers may be from Kenya, where the problem of the unbanked and the underbanked has been solved with mobile financial solution services from telcos, but the whole globe has reacted the same way with only minor differences.

Source: UNDP Accelerator Labs

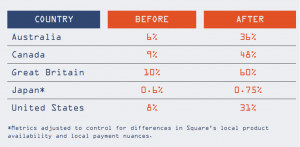

On the retail front, the data from Square shows us the impact of the pandemic on the storefront. Square’s ‘Payments and Pandemic Report’ states that between March 1st and April 23rd of last year, the percentage of sellers on the platform who offered contactless payments shot up from 8% to 31%.** Square’s report also reveals the acceleration of the change with the following:

“In just one month during the COVID-19 pandemic, card usage for $10 to $20 transactions in the U.S. increased two percentage points, from 71% card on April 1 to 73% card on April 29. By comparison, it previously took five months for the share of card payments to rise two percentage points.”

The report also compares the pre-pandemic and mid-pandemic world’s cashless business numbers with the following image:

Source: Square

On the mobile money application front, there has been a similar trend. Below, you can see how the app sessions of top mobile money remittance grew in only 2.5 months.

Source: Fortune

It is obvious that we are going through a mobile money revolution, and a cashless future is not far away. The growth in digital payments and e-money services is still booming, and even conventional banking institutions have stepped in to take their slice from the huge cake that is the digital money market.

Predictions for Cash in the Post-Pandemic World

If we were writing this article last year, we could have said cash as we know will surely be with us for another five years. However, an immense transformation is clearly happening, and most people have already embraced the new and more convenient form of cash. FinTechs have been the game changers during the pandemic, and the post pandemic world will be no different, with one exception: digital banks will emerge even faster!

Both high-street and digital-only banks are investing more and more in new-age digital financial technologies. According to a report by Research Dive, the global digital banking system market is anticipated to rise at a CAGR of 10.0% by 2026, generating a revenue of $1,702.4 million between 2019 and 2026. For an already invested-in-digital industry, a 10% growth is immense, but the real problem for financial institutions is not budgeting – it’s keeping up with the transformation.

Begin the Post-Pandemic Era One Step Ahead

For almost a decade, the pace of the digital evolution of money has been constantly accelerating, and the predictions show us that it’s only going to get faster. One of the most advantageous ways to keep up seems to be outsourcing, and here at Tmob we are ready to help. Catching the latest technology is one of the biggest reasons to get help from a third-party software development team, but if you want to dive deeper into the advantages, we have explained why it makes total sense to outsource technology for financial institutions in our past blog post.

Whether you are looking for the latest tech for a banking institution or a mobile money solution, we’ve got you covered.