Neobanks After the Pandemic: Is the Growth Going to Last?

The pandemic brought many things under the spotlight. Take a trip down the memory lane to two years ago, and notice how you had never even heard of video conferencing tools named Zoom and Houseparty. Seriously, whatever happened to Skype? The exact change of balance occurred in many other areas, and one of the most exciting ones is the foundation of the financial system: banks.

Neobanks, branchless banks, or FinTechs, in general, have been around for a while. But during the pandemic, they have become the rising stars of the finance industry.

Source: Medium.com/fintech-strategy

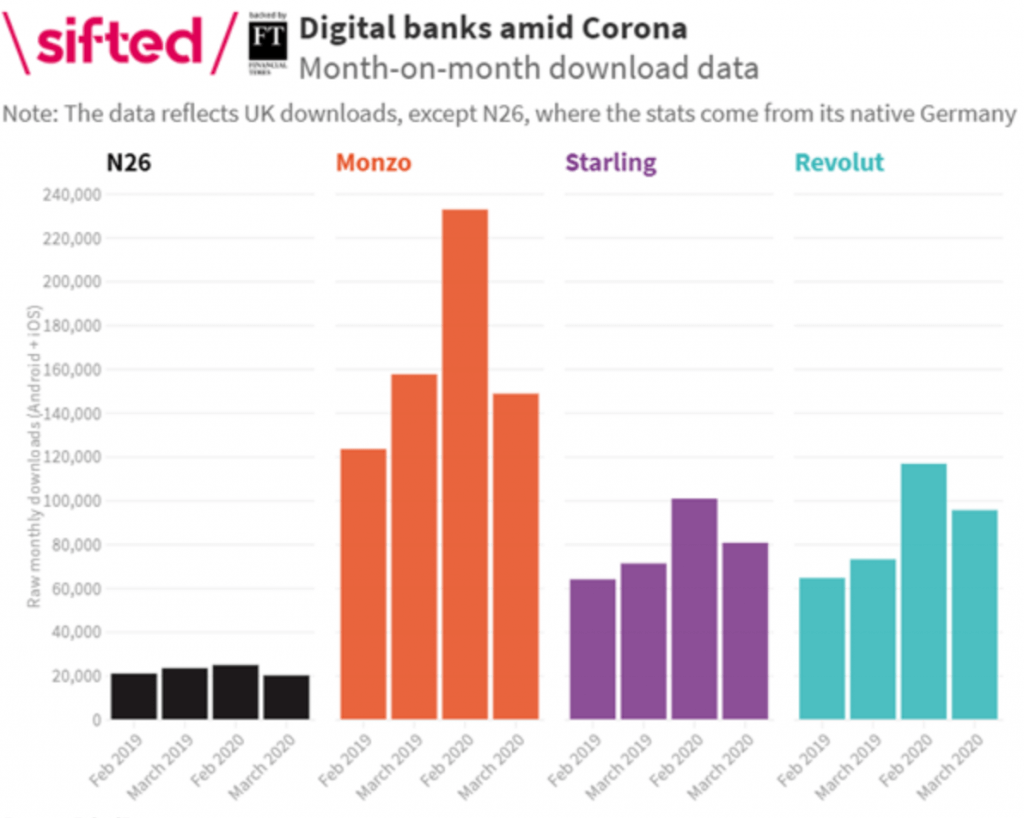

When the pandemic first hit Europe in February, the app downloads of popular challenger banks had dramatically increased, but the fundamental transformation was not going on in Europe. In the first half of 2020, neobanks like N26, Monzo, Revolut, and Monese all announced a decline in their growth rates. On the other hand, the FinTechs and neobanks of the developing countries have seen a significant rise in demand.

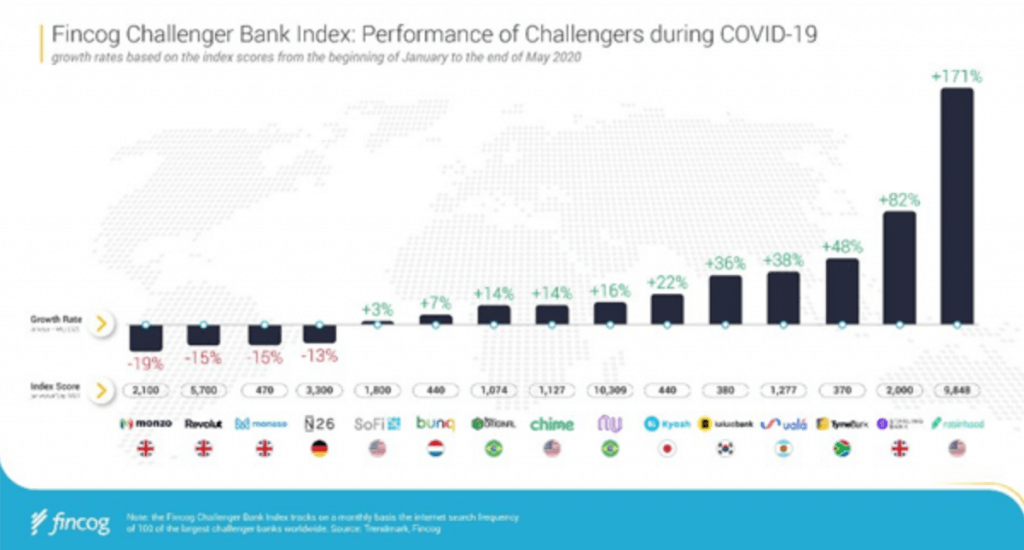

Source: Fincog

At the top of the FinTech growth chart, we see Robinhood from the US, which shows why it is always essential to offer something new to customers. In Robinhood’s case, it was the easy-to-use cryptocurrency investment features that the service provided.

Still, looking at the numbers alone is not enough to evaluate the performances of neobanks since the pandemic was not anybody’s favorite time to invest in any kind of business. Still, we have begun seeing some bold moves from the neobank industry for a couple of months. The main reason behind this rekindling is, like in many other cases, is the younger demographic’s love for digital and convenient solutions, and looking at the researches, we can safely say that no Gen Z’er wishes to wait in a bank or ATM line. However, they will still use a conventional bank if it’s digital enough.

How Gen Z is Transforming the Finance Industry

The younger generation of bank customers may love the digital solutions, but for FinTechs and neobanks, there is still a long way to go to be the real “challengers” of decades-old brick and mortar banks. And although you may have seen some bold marketing campaigns from non-banks that denigrate traditional banks, that’s not even what either neobanks or FinTechs are after.

The US-based FinTech, Current, builds its whole marketing campaign on top of its new-age technologies. And no, they are not a bank.

The US-based FinTech, Current, builds its whole marketing campaign on top of its new-age technologies. And no, they are not a bank.

Source: Eche Design

Looking at the bigger picture, neobanks, FinTechs, and traditional banks are all elements of a financial system that nourishes one another. FinTechs may have opened a new path into the future of financial services, but banks have found a way to adapt to them quickly. Today with open banking regulations, we see more and more neobank/bank collaborations, and that’s all very natural. New research on the financial behaviour of the younger generations reveals an unexpected: 87% of Gen Z uses a bank, but banks are not the one and only financial solution partner of the younger demographic; that’s what matters for FinTechs and neobanks that are after immense growth.

Financial analyst Kunal Gangal sums up what it all comes down to with the following:

“The tech-savvy millennials are the actual beneficiaries of these neo banks who prefer operating and budgeting their finances online. The entire model of neo banks is built with the usage of robotics and artificial intelligence with low human dependency.

With simple account opening procedures and lesser costs than a traditional bank, the neo banks have managed to demystify the entire banking process and bring in simplicity. By leveraging technology, the neo banks have started offering commission-free mutual funds, expense management tools, instant loans, and other financial planning mechanisms with a customer-centric focus.”

Another way the younger generation is changing the financial landscape is happening on the conventional banking front. We may have said banks are in no position to worry about losing customers. Still, we cannot say the same about financial institutions that ignore the new-age technologies. As Gangal emphasizes, customer-centricity has finally come to the finance industry, and mobile applications and digital solutions are the only ways to join the train.

Neobanks are Back on Track with Investment After Investment

After a long pause during the pandemic, investors are once again back on their feet, and one of their favourite areas to go is the future of banking: neobanks. One of the hot topics of last month in finance was Chime’s $70 million funding round, which carried the valuation of the neobank to 25 billion dollars. The more exciting part is, Chime is not alone in the valuation of new-age banking solutions. In the last quarter, neobanks and FinTechs have also become hot stocks. According to the Wall Street Journal, Coinbase, PayPal, Square and Robinhood on average trade at about 15 times their estimated core sales measures for 2022. A neobank for SMBs, Novo, closed a round of $40.7 million in June. An e-wallet start-up from Greece, Viva Wallet also raised $80 million, which altogether tells us that neobanks are finally on the path of being highly profitable.

The Future of Finance is Disruptive, and Anybody Can Join

It is not just tech companies that see the future of finance as disruptive and proactively join in this development process but also other businesses such as social enterprises and non-profit organizations that know this disruption potential. And the best part is, nobody has to invest millions of dollars to build a developer operation to take part. Here at Tmob, we have been developing financial solution platforms that can be customized for any kind of need. Our clients include neobanks, mobile payment services, and even traditional banks. With our e-banking platform, you can join the neobank arena in less than a year, and the possibilities are limitless. See how we can help you with our e-banking solutions, or fill out the contact form to meet with a Tmob expert.

Who are We?

Tmob | Thinks Mobility is a global technology powerhouse, specialized in digitalization and integration solutions, bringing growth and success to businesses and partners with its innovative SaaS, PaaS, and premium solutions since 2009 with Tmob Turkiye (TR) and Tmob United Kingdom (UK) headquarters.

Sources: 1 https://medium.com/fintech-strategy/the-pandemic-as-a-turning-point-for-neobanks-will-they-sink-or-thrive-fe57d071eae8 2 https://fincog.nl/blog/18/performance-of-neo-banks-in-times-of-covid-19 3 https://www.echendesign.com/current 4 https://thefinancialbrand.com/116427/garret-gen-z-craves-good-technology-from-bankscredit-unions-not-neobanks/ 5 https://www.financialexpress.com/money/how-neo-banks-make-managing-finances-easy-for-millennials-gen-z/2303479/ 6 https://www.economist.com/finance-and-economics/2021/08/21/can-neobanks-popularity-outlast-the-pandemic 7 https://www.wsj.com/articles/neobanks-may-not-be-new-or-banks-but-they-are-hot-stocks-11628847006 8 https://techcrunch.com/2021/06/16/novo-a-neobank-for-smbs-banks-41m/ 9 https://techcrunch.com/2021/04/28/greeces-viva-wallet-raises-80m-for-its-neo-bank-targeting-small-business-merchants/