Customer-Centricity is Shaping the Future Trends of Mobile Payments

Day by day, the world goes beyond what we’d expected. A couple of decades ago, we wouldn’t imagine that it would be possible to work from anywhere in the world, shop groceries online and have them delivered within minutes, have personal assistants in our pockets, and internet-connected washing machines and fridges. All these inventions and advancements in technology have something in common: the person’s experience. There’s something else that doesn’t come to mind when we think about technological advancements in everyday life: money & payments. Today, money is not a physical thing to save in some secure place; it is digital and it is accessible without your physical wallet, especially for the younger generations. Like everything else, payments have become a mobile concept, and again like everything else, the future trends of mobile payments are evolving with a customer-centric approach.

Mobile Payment: How It Became Mainstream?

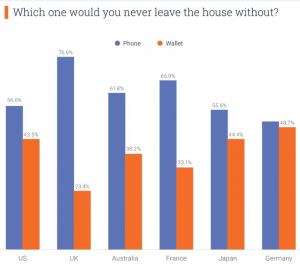

Today, more than half of Gen Z’ers prefer to leave their wallets at home over their phones.

Yes, the concepts of money and payments may have gone digital, and like every other digitalization path, the next step of digitalization of money and mobile payments is customer-centricity. In this article, we are going to discuss increasing pressure on being “customer-centric” and how the mobile payment industry may adapt itself to it. The article will be in the following schema;

- Why is customer-centricity important?

- The rise of mobile payment services

- How do mobile payments improve customer experience?

- Mobile payment statistics

- Future trends of mobile payments

Why is customer-centricity important?

We’ve been calling the last two decades the golden age of digitalization. Every year, a new company in the digital arena has made an appealing emergence, and thanks to the increasing rivalry, customer services have been one of the major focuses of the companies that wanted to shine even brighter. From afar, it may not seem like a big deal, but the end-user can see the advancements in personalization with the precision-made personalized ads. Today, any digital application offers custom-made feeds that are curated just for a single person, and that is you.

Amazon is one of the best examples of personalization in e-commerce. A company that began as an online bookstore is the biggest e-commerce marketplace today, and their journey to the crown has a lot to do with the customer-centric approach. Like him or not, Bezos paved the path to being mega-rich by valuing what the modern-day customer demands, and we are all witnessing the results. Personalized discounts for customer-specific products, easy return policy, very very fast shopping and delivery experience, and lately, growth in another direction with Prime and Twitch. And the most surprising part is, Amazon didn’t take the profit train like the majority of the companies did; it preferred to be a love mark, which carried the company to the top, because something more profitable has emerged: data. Today, many digital world leaders are following Amazon’s path, and it seems to be working for now.

How mobile payment services and FinTechs became the new cool kids on the block

On the payments front, we are seeing a similar pattern. The conventional financial systems couldn’t keep up with the pace of digital adoption of the global population, which opened a huge hole in the industry that emerged many FinTechs to offer a more accessible financial experience for the ones who needed it. The story of mobile payment services and FinTechs might have started with the unbanked and the underbanked, but things turned out to be a tale of customer-centricity. Today, we see end-users in regions where banking has a broad reach to prefer mobile payments and FinTech services more and more every day.

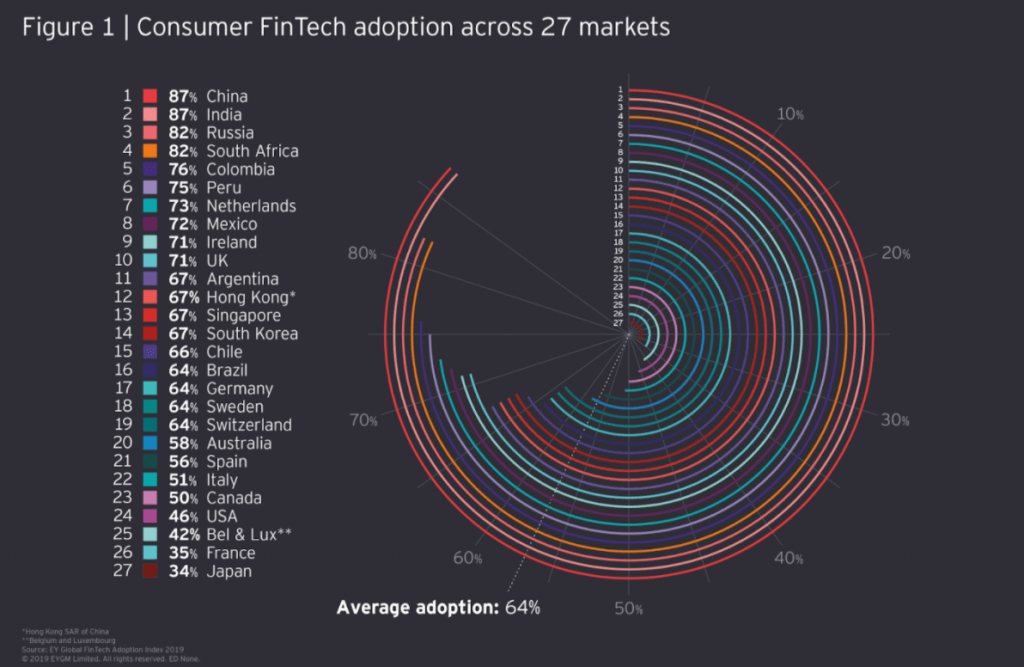

EY FinTech Adoption Index reveals the massive growth rate of the global FinTech adoption, with adoption rates rising from 16% in 2015 to 31% in 2017, to 60% in 2019. In a world where banks have held a financial monopoly for decades, this is revolutionizing, and the main reason behind this adoption is customer experience.

How do mobile payments improve customer experience?

Cash, card, chip & pin, contactless, mobile… If one of these payment methods seems familiar to you, yes, you are in the highly-targeted persona group for companies. On the financial front, these terms are the keys to the customer experience, and the way the end-users are interacting with money is transforming according to their payment habits. NFC, QR code payments, transactions within seconds, auto-calculated group bills, and more are fairly new concepts, and this is just the beginning.

Yes, the mobile payments and the FinTech industry have long become the game changers of the finance industry, but the pandemic was something else that these new-age companies were able to answer with agility. Mobile payments have been on a rising trend for almost a decade, but the pandemic accelerated it. With people becoming afraid of touching cash, contactless payments became mainstream all of a sudden. During the first months of the pandemic, we’ve witnessed some extreme cases like Bangladesh, where the government forced its citizens to use mobile financial services for payments.

On the other hand, digital subscriptions have created an economy on their own. Think about your Apple, Google Play Store, and Amazon Fire Store bills that you are paying monthly. Now, add Netflix, HBO Max, Disney Plus, or any other Video On Demand platform you subscribe to into the equation. In any case, it’s impossible to pay with cash, and if you don’t want to share your credit card info with these third-party services, mobile financial services are the only way to go, and the best part is, some of the MFS services make it as easy as paying your phone bills.

Mobile payment statistics

Mobile payments refer to any payment made using a mobile device. It could be via

- Near Field Communication,

- Sound-wave,

- Magnetic secure transmission (MST) payments,

- Mobile Wallets,

- Quick response (QR) code payments,

- Internet payments,

- Payment links,

- SMS payments,

- Direct carrier billing and

- Mobile banking

According to research done by Stanford Graduate School of Business, it is forecast that by 2023 this will grow to 1.31 billion people worldwide using mobile payments apps over a 6 month period. The current numbers are around 1 billion.

Below, you can see the current market situation:

| Company | Active users | Latest figures from |

| Alipay | 1.2+ billion | Alipay (Q3 2019) |

| 1.151 billion | Tencent (Q3 2019) | |

| Apple Pay | 441 million | Loup Ventures (Q3 2019) |

| PayPal | 305 million | PayPal (Q4 2019) |

| Samsung Pay | 51 million | Juniper (2018) |

| Amazon Pay | 50 million | Evercore ISI, Investopedia (May 2018) |

| Google Pay | 39 million | Juniper (2018) |

(source:https://www.merchantsavvy.co.uk/mobile-payment-stats-trends/)

According to the 2019 Mobile Payments Market – Growth, Trends, and Forecast (2020-2025) report by Mordor Intelligence, the use of mobile payments is set to continue its inexorable rise with a compound annual growth rate of 26.93% between 2020 – 2025 as mobile payment applications like PayPal, Samsung Pay, Apple Pay, AliPay, WeChat Pay are used to accept payments.

Future trends of mobile payments

To see the future trends of mobile payments, we should analyze the past. Above, we wanted to summarize and highlight the link between customer-centricity and mobile payment. As you kindly review, there is a direct correlation between customer demand and payment methods. Therefore, payment reinvented itself in accordance with the popular term “customer-centric” approach.

As futurists are mostly talking about 5G, AI, Blockchain, VR, and AR, we are expecting payment methods to take their position in these platforms and technologies as well and evolve again and again. It’s clear that the future trends of payments are 100% mobile, and here at Tmob, we are proud to be a part of this revolution. See how we contribute to the quick transformation of the state of cash with two of our main products.

Tmob Mobile Financial Solutions Platform

Who are We?

Tmob | Thinks Mobility is a global technology powerhouse, specialized in digitalization and integration solutions, bringing growth and success to businesses and partners with its innovative SaaS, PaaS, and premium solutions since 2009 with Tmob Turkiye (TR) and Tmob United Kingdom (UK) headquarters.

Sources: 1 https://liveperson.docsend.com/view/tm8j45m 2 https://www.ey.com/en_gl/financial-services/eight-ways-fintech-adoption-remains-on-the-rise