Embedded Finance and Banking as a Service Explained

We’ve long left behind the times when banks monopolised financial services. For almost a decade, fintechs and neobanks have been joining the financial services arena, bringing more convenient and streamlined financial experiences to customers. And lately, with open banking, things are about to take a turn with two recent fintech trends that will further disrupt the financial arena: embedded finance and banking as a service (BaaS).

As a SaaS and PaaS powerhouse that’s been creating solutions and platforms aiming to revolutionise payment services and financial services, we decided to explain the two new trends that we’ll be talking so much more about in the following years. If you want to dive deeper into future trends, read our blog, focusing on the future of financial services.

What is Embedded Finance?

If you’re in the finance industry, you must be aware that companies that have nothing to do with financial services are stepping in to get their share of the pie, whether with a payment service, a loyalty-backing mobile wallet, or an end-to-end fintech product.

Embedded finance is exactly this business model: non-financial companies offering a financial service one way or another.

The most successful examples come from China, where super apps dominate the financial services arena. WeChat, the biggest messaging platform in the country, has 900 million fintech service users, taking the crown of the financial services in the 1.4 billion-populated country. AliPay (230 million users), Grab (187 million users), and Gojek (170 million users) follow WeChat’s path with super-app financial services.

The Asian market seems to be reaching a milestone with the mobilisation of financial services thanks to mobile payment technologies and super-apps. And now it’s the West’s turn to complete the transformation of the new age.

On the other side of the world, software powerhouses like Apple, Google, Facebook, and e-commerce giant Amazon are strengthening their hands in embedded finance services. And there’s no doubt that we’ll be living in a world where traditional banks will not be touching the daily, basic financial transactions as much as they used to.

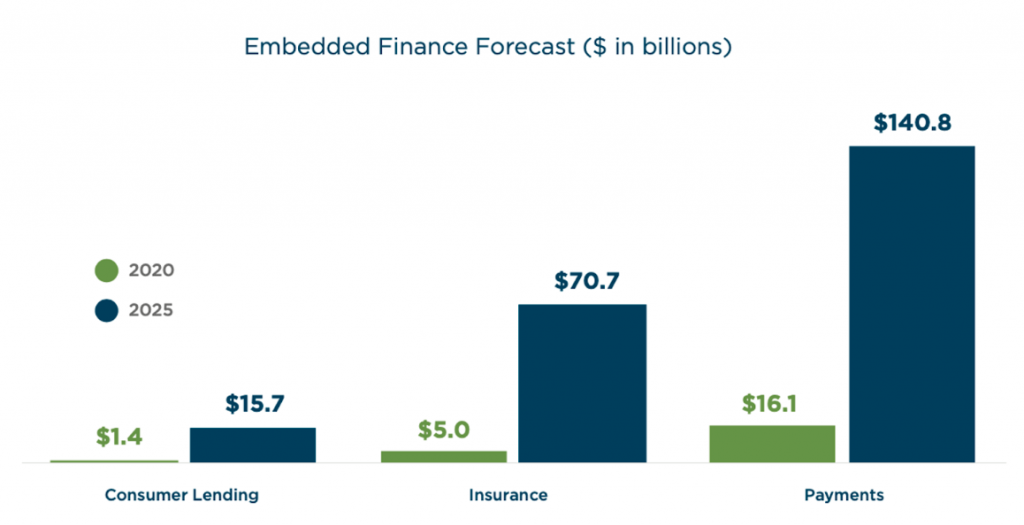

Source: Forbes

Tmob CEO Tunç Aykurt shares his thoughts with the following:

“When we look at the future trends in finance, we clearly see that mobile is the main channel, replacing bank branches. The end-user of today demands a fast and convenient financial experience, and mobile devices offer the fastest solutions in many areas. We expect new, outstanding fintechs to emerge soon.”

What Is Banking as a Service?

Fintechs may be covering a wider range of populations every other day, but no matter how much they grow, banks are here to stay, and they will be standing in a more crucial place thanks to open banking.

Although 1.7 billion people still remain unbanked globally, banks cover more than 70% of the global population, and they have something that nobody else does: data and infrastructure. The good news is that, with the transparency that comes with PSD2 regulations, banks are ready to share their services and data with third-party companies that want to make it easier for the end-user. And that’s where Banking as a Service (BaaS) steps in.

As it is obvious by its name, banking as a service refers to banks offering their services to third-party companies. Let’s say you’re running an e-commerce company and want to offer your customers a light banking service with easy loans, wallets, and more. Instead of building a system from scratch, you can outsource the service from a bank, bypassing many of the challenges.

Your Key to New-Age Financial Products is Ready

The future is very exciting in many aspects, and financial services hint at a futuristic era. Even this year, many fintech trends are decentralising finance. And as a SaaS and PaaS provider that has 13+ years of experience in the financial products arena, we’re doing everything we can to stay one step ahead of the financial transformation.

With our future-ready fintech solutions platform, you can have your share of the new financial infrastructure, whether you’re thinking about building a BaaS service or embedding financial products into your ecosystem.

See what you can get with our future-ready fintech solutions platform: https://thinksmobility.com/products/fintech-solutions/

Here at Tmob, we develop financial solutions and new-age digital banking products that are powered by the latest financial technologies and open banking. On top of that, we take your product on day one to design the best user experience with our UX/UI team, Shape.

Tell us what you need, and let’s tinker with our ready-to-use platforms to offer you the best.