Branches Out, Online Banking In

Everybody is aware of the fact that the future of banking is digital. When you think about the last time you visited a bank, that’s concrete proof of the transformation. Well, unless you’re working at a bank. The reason behind this is, of course, the ever-evolving world of online banking. While bank customers had been able to make money transfers and simple payments before, with today’s banking technology, they can even apply for loans via their smartphones. The numbers show us that bank branches are less popular than ever, and it seems like we are awaiting a world with branchless banks.

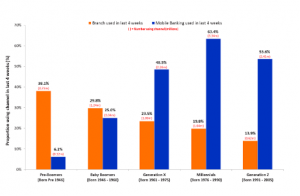

According to Roy Morgan Australia’s 2018 research, the new generation prefers not to visit a physical bank unless they really have to. Looking at the chart below, you can see that branches are working to serve mostly baby boomers and pre-boomers.

Source: Roy Morgan

Source: Roy Morgan

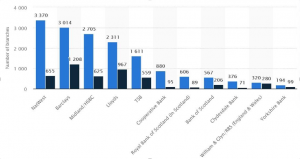

Another study by Federal Research states that older, wealthier, and self-employed consumers are more likely to visit bank branches than the regular customer. Statista’s chart from 2018 (below) shows us an even more surprising change in the decline of bank branches in the UK. The chart compares 1981 and 2018 in the number of total bank branches, and the drop is staggering.

Source: Statista

Source: Statista

COVID-19’s effect on bank branches

It is obvious that sooner or later, bank branches are going to disappear, and the COVID-19 pandemic has accelerated the process as it has done in many other areas. The same rules apply when we think about the form of money. Some countries like Sweden have started to consider going 100% cashless since 80% of Swedes already prefer a debit card, credit card or other online payment services to pay for their purchases. With the pandemic, the cashless society has more than doubled itself worldwide. For safety reasons, people started to search for ways to perform all of their money transactions in a digital way. The volume of online shopping has skyrocketed, making people dependent on online payment options. That’s where the new-age FinTech companies and online banking solutions stepped in. Here’s how COVID-19 affected the definition of money and banking.

Money is more abstract than ever.

According to Accenture’s latest study, there was a 60% decline in the number of withdrawals from cash machines during the pandemic. In the UK, 76% of respondents stated that they planned to use less cash post-COVID-19. This not only means a transformation in banking systems but also gives us a hint about the future of economics.

The lockdowns forced banks to find new ways.

Major banks all around the world had been working on raising their customer satisfaction scores with the digital approach way before the pandemic. With the lockdowns that came with the pandemic, they accelerated their digital projects to meet their customers’ demands. According to J.D. Power’s pre-COVID-19 study from earlier this year, 51% of Gen-Z customers receive banking advice and guidance through digital channels, and the overall share of customers who use digital channels to get banking advice is 36%. As you’d expect, the numbers are rising every year, forcing banks to shut down branches one by one. The better news is, the customer satisfaction scores in digital access are on an exponential rise, compared to the in-branch satisfaction scores.

Online banking offers what conventional cannot

Of course, the pandemic is not the only reason for customers to prefer online banking. Since banks have managed to cut back a considerable expense by closing the branches, they can offer better deals for their customers in terms of loans, savings, and interest rates. Although better deals may be the leading force that makes people join the digital side, there are many more advantages to using online banking.

Budget control

As people get used to using online banking, they get a clearer picture of how they are doing with their money. Being able to see all of your transaction histories might once have been a dream, but today, it’s real, and it’s about to get even better with open banking.

Mobile money transfers

Since every bank offers a mobile banking application, people can do fund transfers between accounts with just a few taps on their screens. Compared to visiting a branch or even an ATM, the new way is much more comfortable. Plus, with the new integrated FinTech technologies, it is becoming free of charge to make cash transfers between different banks 24/7.

Online payments are just easier

Paying all kinds of bills in the same interface may seem usual, but it was considered a sci-fi movie a couple of decades ago. Think about paying all of your bills, taxes, and more twenty years ago; you needed at least one whole day.

No more lines

Of course, one of the most reasonable causes of the shift to branchless banking is, well, the branches. Decades ago, customers had to wait hours to do a single little thing at a bank branch, and now, it is all digital and so easy to use that even the baby-boomers have begun using the technology.

Start your digital transformation one step ahead

Here at Tmob, we have been designing and building mobile-centric unified solutions for many industries, and banking is one of our passions. We have designed e-banking, HCE wallet, and MFS platforms that can be customised the way our partners need. To see what we have done, you can visit the e-banking product page.