Emerging Technology Trends in Financial Services

Money has always been one of the top priorities of humankind, and since it is one of the essentials, people have always been cynical about trusting others to secure their money. Even today, there are 1,7 billion unbanked people. In a world where everything flows digitally, that is a lot. Banks may be powerful, but if they can’t manage to adapt to the modern age, a new era for financial technologies is about to begin.

Sure, there are many other reasons why a considerable amount of the population remains underbanked. Especially in emerging countries, the ratio of the underbanked population is a lot higher. Fortunately, financial technologies are on the rise for those who don’t have the reach or prefer to use banking systems. Today, financial technology systems can be as reliable as banking systems without the need for procedures. In this article, we are going to focus on emerging technology trends in financial services, and how they can fill a massive gap.

FinTech is here to stay

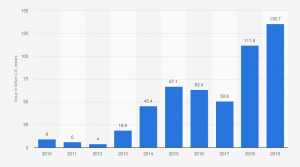

It would have seemed nearly impossible for FinTech companies to even dream of doing what they are doing today, but thanks to the conveniences that come with digitalisation, a revolution in the financial systems is happening. We see more and more start-ups to join the FinTech game, and they have a valid reason: people love to have control over their money. The industry is becoming so big that in 2014, global investments in FinTech has more than tripled. After that, the new financial business model has only received more attention.

Global investment in FinTech – 2010 to 2019. Source: Statista

The better news is, with today’s advanced technology, it’s easier than ever to build a FinTech platform, or even to integrate the technology in the businesses.

Blockchain

With the rise of cryptocurrency, the incredible technology of blockchain entered our lives, and it’s not going anywhere. The technology allows anyone to transfer money without any banking systems since the system includes literally everyone. According to The Harvard Business Review, blockchain will disrupt banks the way the internet disrupted conventional media. We are already in a decentralised world, and it’s time that our money follows the trend.

Big data is worth more than actual money

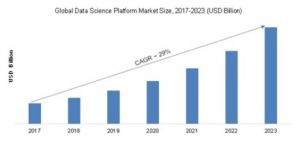

Data has always been essential for businesses, but for a decade, the value of consumer data has skyrocketed. The reason is straightforward; before the digital revolution, there were drawn-out procedures to gather accurate data on customer behaviours. Today, since everyone is invested in the digital world, it’s easier to analyse what people want from the services they use. The data market is clearly on the rise. Instead of doing surveys, companies need good data scientists that will tell them more than any other survey can.

Source: Market Research Future

Apparently, the best way to gather user data is to build a platform that can analyse its own user data and give reports. With our MFS Platform, you can use the analytics tools on day one without the need to set up implementations.

Robotic Process Automation

One of the biggest trends in the finance industry is RPA, also known as Robotic Process Automation. RPA automates almost all of the workforce-requiring automatable financial processes such as customer on-boarding, verification, risk assessments, security checks, data analysis and reporting, compliance processes. In short, RPA saves companies a lot of time and budget. With the rise of AI, RPA systems today also observe and learn the workflows and automate them. The technology seems like it will be one of the key elements of the future of the finance industry.

Innovations in mobile payment

Another fast-emerging trend in financial services is undoubtedly mobile payment systems. The giants like Apple, Alibaba, Google, and Tencent are all aware of the financial demand of the future, and that’s only natural. Today, even companies who have nothing to do with finance are joining the game to give their customers a new and conventional payment and cash management method. With remarkable technologies like NFC and facial recognition, mobile payments have become more secure and convenient than credit cards, and it’s safe to say that in the future, nobody will carry a physical wallet with them.

A decade ago, to build a mobile payment system, companies needed to spend an enormous amount. However, today, there are ready made systems that can be adapted to any business with very little effort, and the results are amazing.

The biggest winners of the mobile payment integrations are, as expected, the telecommunication companies. With their massive customer portfolios and technological backgrounds, telcos that are shifting towards FinTech solutions will likely be the major players in the mobile payment and financial technology services.

We have partnered with two of the biggest telcos, Vodafone and Turkcell to build mobile wallet services, and both companies have reached millions of users in a few years. You can check what you can do with Tmob’s mobile financial solutions platform and our case studies for further information.

What you can do with Tmob MFS Platform

Here at Tmob, we have partnered with more than 100 businesses to create mobile payment systems, financial solutions, and unified online commerce platforms for more than ten years. Our Mobile Financial Services Platform offers a unified digital experience that works on every platform. With our platform’s integrated analytics tools, you can gather data on your customer profiles to build new strategies and increase your revenue.

If you have any questions, you can book a meeting with our experts by filling out the form here.