Here’s Why Every Company is Launching a Payment or FinTech Application?

Money has always been one of the most influential driving forces for humankind, and as a generation, we are lucky to witness the beginning of a new era for money. As expected, everyone wants to move into the future with a strong hand.

Ten years from now, when someone in Gen Z hears the word, “money,” they won’t be picturing what the middle-aged person of today does. Cash is already no longer cash, and the transformation is happening quicker than ever predicted; money, the most powerful tool we have, is finally becoming fully-electronic. For more than a decade, visionary companies have been trying to find ways to become the next mediators of money, but recently, everybody seems to want to join the game.

Mobile Payment Has Already Become the Norm for Millennials

We are finally in an age where millennials have become the largest population in many countries such as the US and, as a result, they have become the largest group of shoppers. Today, every major marketing company is working to reach millennials and the younger generations, but the latest research has shown that there is one essential step to steal the millennials’ attention, and that is mobile wallets.

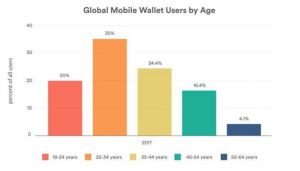

According to a report by FintechNews, millennials are the largest group using mobile payment services. Another survey by Airship states that in 2016, 67% of millennials stated that they were mobile wallet users.

Source: Fintech News

So, the main motivation for companies getting into the fintech arena seems to be embracing future shoppers, but that is not the only reason. First, it is easier than ever to launch a mobile financial solution application. Thanks, technology. With today’s technology, even small businesses can launch their own mobile payment applications.

Thanks to advancements in mobile security, digital technologies, and customisable ready-made platforms, offering your customers a mobile payment tool of your own is almost as effortless as launching a website for your business. There are more benefits of owning a mobile payment application or an e-wallet, with your company’s branding, every day. Of course, nobody is trying to compete with tech giants like Apple Pay, Google Pay, Amazon Pay, or AliPay. For medium-sized companies, building a mobile payment service is an element of marketing and a strong brand identity. Since this is virgin territory for many brands, it is safe to assume that branded mobile payment systems will become the new marketing tools of the next decade. Here is what’s already happening:

Brands Are Integrating Mobile Payment Applications Into Their Loyalty Programs

Having a loyalty program is now the default for all businesses, even the smallest ones. Returning customers are one of the top forces that keep a business running. According to a study by Northwestern University, loyalty programs can increase sales by 20 percent.

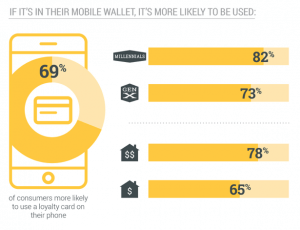

A decade ago, companies used to hand out loyalty cards to their customers, which is not sustainable in today’s market. Then, mobile loyalty applications replaced cards, which changed everything for the better, both for the brands and customers. 69% of consumers say that they are more likely to use a loyalty card if it’s on their smartphone. For millennials, the number is 82%.

Source: Urban Airship

We have mentioned that with today’s resources, it is exceptionally easy to launch a mobile payment service, and incorporating it into your loyalty program is a no-brainer. At least that’s what the majority of visionaries think. With a mobile wallet that’s filled with perks exclusive to your brand, your customers will definitely return for more.

Credit Card Fees Are a Thing of the Past

Although being paid via credit cards has been very helpful for companies for years, with today’s banking and e-money solutions, there are new and better ways to collect payments, especially for e-commerce businesses. According to NerdWallet, some credit card companies can charge as high as 5%. With your own payment service, you can save a lot in the long run.

An appreciable convenience for the customers

Giving your customers an integrated payment method that’s as safe as a credit card saves them a lot of time. When you add the advantages of loyalty plans, your payment solution becomes the best option for returning customers. Also, it makes customers return!

It seems like mobile payment applications will be the next loyalty cards, and once again, the quickest ones to adopt them will benefit the most. The best part is that you don’t have to do much on the coding front; we’ve got it covered. With our MFS platform, you can have any feature you need without spending months coding. Of course, since it is highly customisable, you can adapt it for different experiences; the possibilities are infinite! At Thinksmobility, we have been working on financial application platforms such as digital banking, mobile financial solutions, and e-wallets for almost a decade now.