How Open Banking Can Help FinTech in a Post-COVID World?

We live in a world where technology, the ever-advancing essential in the modern human’s life, is making our daily lives smoother and more complex at the same time. New technologies come with great conveniences, but they can also make things more complicated than before. When it first entered our lives, online banking was unbelievably convenient for basic banking transactions, and it has evolved into something else that makes everything easier. But with other fund-management businesses joining banks in the finance arena, it has become somewhat tricky to manage finances for the end-user. Especially during the COVID-19 pandemic, more and more people, primarily the unbanked and the underbanked, have started using mobile payment systems, e-wallets, and digital banks. It might have been a good year for the fintech companies, but after the pandemic, things may become chaotic. Thankfully, we finally have a solution that seems to be launching a new era in financial technologies and banking: open banking.

The COVID-19 Effect on Banking and Other Financial Systems

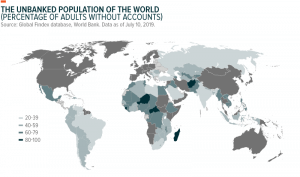

Once again, everybody’s main focus is the coronavirus pandemic and the immense transformations it has caused. The pandemic is unfortunately in a more frowning state than last year, which forced many governments to take new measures. The first wave of measures and lockdowns changed the scheme of things for many industries, and fintech was one of them. According to LightCo’s survey in the US, 82% of consumers were afraid of visiting a bank, and 63% said that they were more inclined to try a digital fintech app. Considering these are numbers from a world-leading country like the US, you can imagine what the emerging markets where banks can’t reach the majority of the population are doing. Below, you can see the unbanked population rates by country. COVID-19 was yet another challenge for emerging countries, and fintech applications, the majority of which are provided by telecommunication companies, were there to offer quick help for the unbanked.

Source: World Bank

Source: World Bank

It seems that fintech will be the main player after the pandemic, and the only option for financial institutions is to build solid partnerships with the help of open banking.

European banks are embracing the open banking strategy

Europe is leading the open banking approach. In only a couple of years, the continent has seen a massive transformation in its financial institutions, and the world is reacting positively. To learn more about the impact of open banking, you can read our article, “The Increasing Power of Open Banking.” To learn more about the European regulations on open banking, click here.

According to FinTechFutures’ article, 69% of European financial institutions have increased their number of fintech partnerships in 2019, and the vast majority of executives have stated that they are working with more than one partner to unlock the real potential of open banking.

Although it may seem like it would increase competition, open banking is a great opportunity for financial institutions to finally work together in solving the ever-growing unpopularity problem. In a time where branchless banks are the new-age and a favored competitor against decades-old institutions, banks need open-mindedness more than ever, and the ones who are adopting this new approach are actually progressing.

With open banking, getting into fintech is more reasonable than ever

Fintech is undoubtedly one of the top industries right now, and it will only get more popular. Even the banking systems are being transformed, and the advancements in financial technologies are the main reason. Here at Tmob, we are working with both banks and fintech companies to improve digital wellbeing. Our clients include conventional banks, digital banks, telcos, and other businesses who want a strong presence in the financial arena.

Source: Digiday

Since we are working with companies on both sides, we know what is needed best to build the most useful platform, while including all the essentials. On the e-banking front, Vive Bank, a UK based all-digital bank, stands out with its open banking features, and it uses our e-banking platform. On the other hand, we have MFS and HCE Wallet platforms that power industry-leading telcos and e-money companies. With a tailor-made platform like ours, your business can begin its journey one step ahead. Here at Tmob, we specialise in financial technologies, and all our platforms offer the essentials and more. Here is what you can do with our modules and platforms.

Open banking

Our platforms take advantage of the convenience of open banking. One of our clients, Vive Bank, is one of the first financial institutions to fully implement the open banking approach in the UK. Thus, we have had the chance to learn what works best for various branches in the financial industry.

An omnichannel experience

Building a mobile application alone is not enough. Our platforms have been designed to work on all platforms, so your customers can have a seamless experience across every digital channel.

Enhanced security

All of our platforms have been designed with top security measures, using advanced encryption technology to avoid any unauthorized interference.

You can check the specific features of our platforms by visiting the pages below: