Meet Vive, a New-age Banking System with Tmob’s Open Banking Infrastructure

The digital age came with many alternatives for the end-user in different branches. Today, there are more shopping, education, entertainment, and travel options than ever before. Some people even utilise tourism services that don’t require them getting out of their bed. Of course, all of these astounding transformations have affected the banking system and people’s financial needs as well.

Banks have long been undergoing a digital transformation, and customers got more and more used to paying their bills, transferring their funds, and checking their savings accounts from the web or their smartphones. Today, more than half of the population prefer doing their banking transactions online. In a scenario like this, it was inevitable that branchless banks would be founded. Our new client, Vive, is one of the leading players in this transformation. Based in London, Vive is a digital bank that has no branches. The bank has just begun its journey with yet another groundbreaking feature for the industry: open banking. In this article, we are going to share what we have achieved while building a platform for Vive, offering some insights you may find useful.

Digital banks are more convenient. At least, that’s what the numbers say…

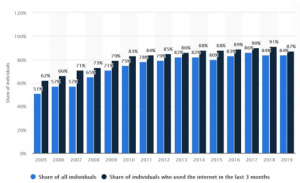

When you look at the numbers, it is clear that branchless banking is the future of the industry. Banks, too, are aware of this fact, which is why they are spending a fair amount of their budgets on digital transformation. But, in cases like Vive, there is a blank slate: fully digital and branchless from day one, as people want. According to Consumer Affairs, 80% of US citizens prefer doing all of their banking transactions digitally. Even more surprisingly, Sweden plans to be the first country to go cashless, since more than 91% of its citizens prefer online banking according to the 2018 report by the European Banking Federation.

Online banking usage in Sweden

Source: Statista

In an environment like this, it is safe to say that the future of banking is all-digital, and even decades-old banks are following the trend. According to a Business Insider report from 2019, the increasingly competitive digital-banking only landscape is going to cause banks to overhaul their entire business, catering to the demands of the digital era.

Unlike e-wallet systems, Vive is a real bank that offers almost everything that a conventional bank does

Another rising trend in the financial world are e-wallet systems and mobile financial solutions that don’t require clients to use a bank. Although they fill a huge gap for the unbanked and the underbanked, Vive’s case is nothing like an e-wallet solution. From day one, Vive was planned to be an alternative to the conventional banking systems, but without the lengthy procedures, branches, and practically everything else that bank customers are tired of in the modern age. With Vive, users can take out loans, set up savings accounts, and, of course, make fund transactions all from a mobile application. In short, Vive is the perfect alternative to a bank for the majority of the population.

Building a unified system for Vive was not like building a mobile application for a conventional bank. We had to design every detail for the new-age user. In the end, we have created an omnichannel platform for a branchless bank that can rise to every possible scenario. Here are the top features of the platform that we have used with Vive Bank.

Open banking

One of the defining features of Vive is that they use a new banking methodology which is built on their customers’ trust. We have created a secure system for Vive so that they can share information with third-party APIs without any security concerns. In the end, this has made the company more open, trustworthy, and demand-meeting for the modern age user. This means they don’t have to stray out of their digital ecosystems.

Loans, but simpler than a conventional bank

One of the things that makes Vive an actual bank is their loan offerings. Just like conventional bank customers, Vive’s customers can take out loans, but in Vive’s case the process is more straightforward and all-digital, which is a further bonus for the modern user. The best thing is that Vive’s platform is safer than a conventional bank thanks to its open-banking policy.

User-friendly savings accounts

Vive allows its customers to set up savings accounts with fixed rates. Since they serve the unserved and a new generation of customers, we have decided to go all open and clean so customers can check how their savings are growing without any complications. To achieve this, we went with a user-friendly and modern design that’s built on easy-to-read charts and numbers.

A unified user experience

We have built Vive’s mobile applications and website with the same design language so its customers can enjoy a seamless financial experience.

The most essential: security

One of the biggest concerns which makes customers avoid online banking is security, and we are aware of that. To prevent any security flaws, we use advanced encryption technology for our e-banking platforms. In Vive’s case, security is even more essential due to the brand’s open-banking policy and we have managed to pass all the tests.

Want to learn more about our e-banking solutions? Visit our page or book a meeting by filling out the form with a ThinksMobility expert to see what else we offer.