The Inevitable Rise of Mobile Financial Technologies

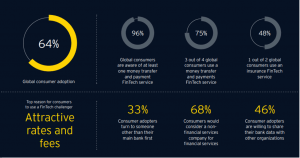

There is no doubt there have been dramatic changes in the financial world. With mobile financial technologies entering the market and gaining massive recognition in the past couple of years, the pace of the transformation has only been speeding up. Most responsible for this immense shift are technology companies that are working on mobile payment platforms that run outside the banking systems. In short, the ones who manage to bank the unbanked. According to EY’s Global FinTech Adoption Index from 2019, fintech adoption has more than doubled in the past two years, and 64% of the people who have an online presence are financial technology users. However, the really surprising fact is that 33% of consumer adopters turn to someone other than their bank and that 68% of consumers have stated that they would consider a brand that isn’t associated with finances for their financial services. You can see more about the strong impact of the newcomers in the finances industry by looking at the charts below:

Source: EY

Source: EY

Technology giants are going all-in for MFS

With the help of the latest technological achievements in digital banking and new regulations for open banking, banks are joining the mobile financial solution industry one by one. The real game-changers in the industry, however, are the technology giants like Google, Amazon, Samsung, and Alibaba. According to eMarketer, approximately 36.3% of smartphone users made an in-store mobile payment at least once every six months last year. This year, with the pandemic accelerating the digital transformation in every industry and increasing demand for online shopping, we’ve seen an incredible shift in mobile payment usage as well. While it seemed like a distant prospect for society to go entirely cashless just a couple of years ago, today it seems quite possible for most of the global population. According to Financial Times research, there has been a 62% drop in ATM withdrawals between 2019 and 2020 globally. That statistic alone says a lot about the near future of money and mobile financial technologies.

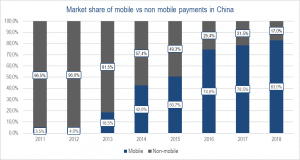

China was one of the first countries to adopt a mobile approach in terms of payment methods. Companies like Alibaba and WeChat have been two of the main pioneers of the financial transformation, and today, their transaction volumes are higher than banks. According to Dauxe Consulting’s chart, around 83% of all payments were made via mobile modes in 2018 in China.

Source: Dauxe Consulting

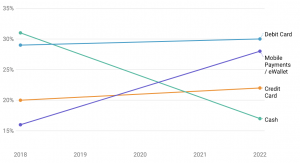

China may be going too fast, but predictions show a similar picture for the rest of the world as well. Today, the share of credit cards, cash, and mobile payment methods are almost the same. However, according to predictions, physical money will no longer be a popular payment tool in two years, and the successor of cash will be mobile payment technologies.

Source: Merchant Savvy

Open banking is a key part of the transformation.

Open banking, letting banks share account information with third-party APIs in the most secure way possible, is undoubtedly the future of banking. With banks letting apps take advantage of user data, new types of fintech start-ups are joining the market. Revolut is one of the most popular businesses in the arena. It builds a bridge between the conventional banking systems and new-age MFS systems. The all-digital banking application has started down a new path with its June update that integrated the technology of open banking. The application now lets its users see all of their online financial information on the same application, which makes things easier for everyone on multiple levels. As you’d expect, almost every “revolutionary” bank and MFS applications are following this trend one by one. Sooner than expected, everybody else in the industry will have to adapt to the new normal.

The next step for mobile payment is being taken by merchants

Since it is easier than ever to build a mobile financial application, many brands from various industries are stepping into the fintech game. As expected, their motivation is pretty different from the tech giants, banks, and telecommunication companies; their main basis is transactions which are made inside. Merchants are making customers use their e-wallets or payment systems through loyalty-program implementation, which seems to be working for many. So, yes, in a world where it is incredibly convenient for users to open new accounts with every other brand, and for brands to build new MFS or e-wallet apps, we can only expect a future that is fueled by electronic money.

When we mentioned that it is easier than ever to launch an app that focuses on financial technologies, we were serious. Here at Tmob, we have been designing and building omnichannel MFS platforms for banks, telcos, and merchants for their financial fronts. Our MFS platform, which powers the mobile fintech applications of leading brands like Vodafone and Turkcell, offers various features that we can adapt to the needs of any business.

Here is what you can get with our tailor-made MFS platform

Here at Tmob, we are fully aware that the future is all digital and, with that in mind, we aim to build a better future for everybody. For more than a decade, we have been designing and building tailor-made platforms for hundreds of companies from various industries, and mobile financial technologies are at the top of our list of priorities. In Turkey, we have partnered with two of the biggest telecommunication companies, Vodafone and Turkcell, to develop their MFS services, and the feedback has been amazing. Since our MFS platform is customizable for every need, every business can take advantage of it effortlessly. To see what our platform can offer you, visit our MFS webpage listed.