Top Fintech Trends to Look Out for In 2023

The fintech landscape is constantly evolving, and 2023 promises to be an inspiring year for the industry. As marketplace banking continues to gain traction and we enter the post-open banking era, we’re also seeing a rise in alternative financing options that are disrupting traditional financial models and shaping fintech trends.

Fintech trends have the potential to significantly impact the way we do business and could lead to new opportunities for growth and innovation. In this blog, we’ll take a look at some of the key fintech trends to watch out for in 2023. Whether you’re already deeply involved in fintech or just considering dipping your toes into the water, it’s crucial to stay informed about the latest developments in this rapidly evolving field.

1- Alt Financing

Alternative financing, also known as alt finance, refers to financial products and services outside the traditional banking system. These alternatives can include crowdfunding platforms, peer-to-peer lending, and online lenders, among others. Alt finance is a growing sector that is shaping the future of fintech and the finance industry by providing more choice and accessibility to consumers and businesses seeking financial services. In short, it’s the main thing that’s shaping future trends for fintech.

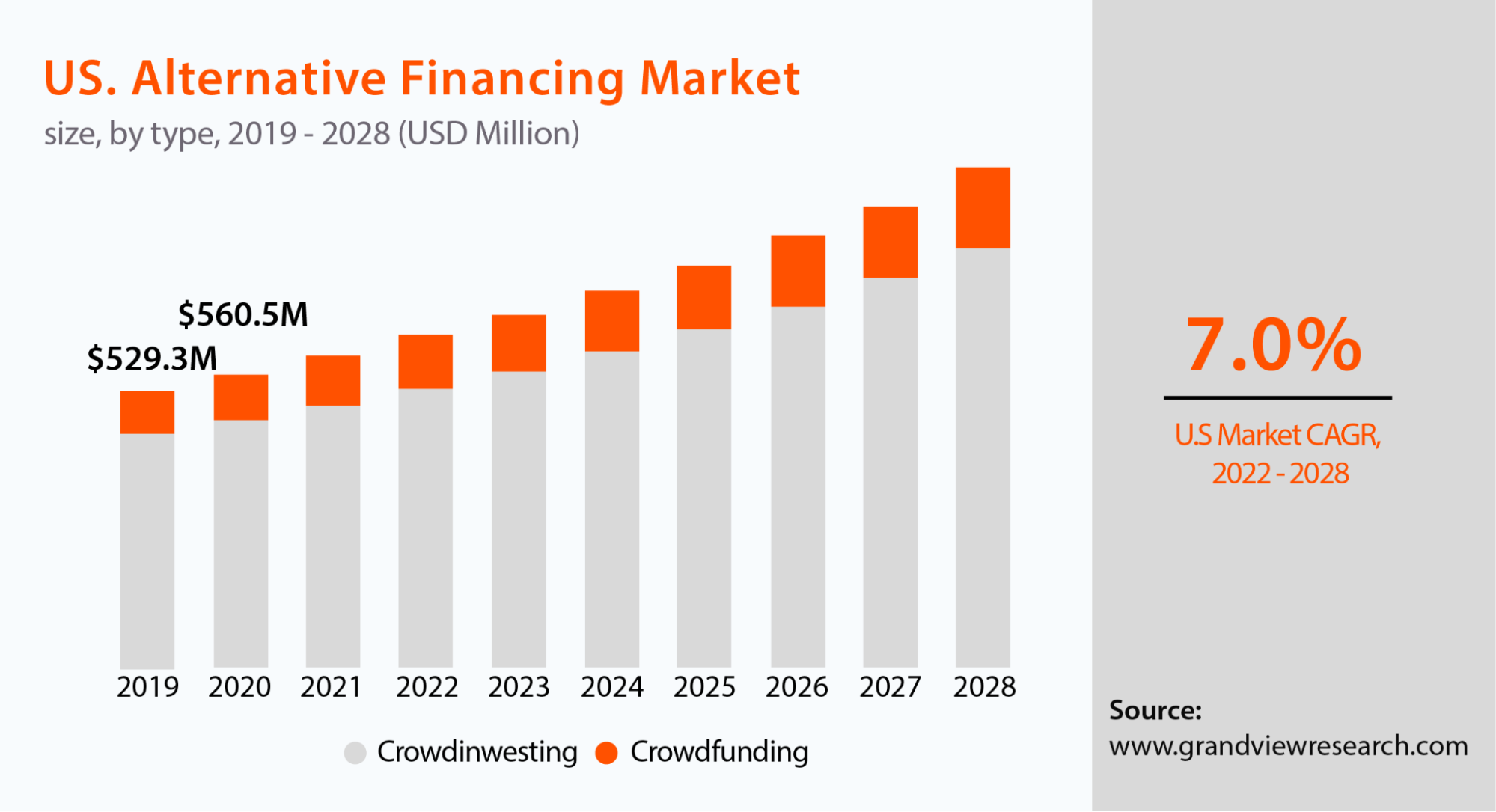

The new, democratised financing model is expected to grow at a 7% CAGR till 2028, and with the rise of disruption, we can only expect it to get an even bigger market share later.

Alt-finance democratises access to financial services by making it easier for individuals and small businesses to obtain funding, particularly those who may not qualify for traditional bank loans. It also provides a more streamlined and convenient experience for consumers, with many alt finance options being fully digital and requiring minimal paperwork. As a result, alt-finance is poised to play a significant role in the future of the finance industry, and its growth is likely to continue as more and more people turn to these alternatives for their financial needs.

2- BNPL

The buy now, pay later (BNPL) model, also known as deferred payment or instalments, has seen significant growth in the fintech arena in recent years. This model allows consumers to purchase goods or services and pay for them at a later date, typically with no interest or fees. Instead, the merchant pays a fee to the BNPL provider for offering this service to its customers.

BNPL has become increasingly popular among consumers due to its convenience and flexibility. It allows people to make purchases without having to pay for them upfront or use a credit card, and it can be an attractive option for those who may not have a credit card or who want to avoid accruing credit card debt. BNPL providers also often offer additional features, such as pausing payments or splitting a purchase into smaller installments.

The rise of BNPL has disrupted the traditional credit card industry, as it provides consumers with an alternative way to finance their purchases. It has also led to the emergence of a new type of fintech company, with many startups entering the space and competing with established players. The BNPL market is expected to continue growing in the coming years as more merchants offer this payment option and more consumers adopt it.

One of our latest projects, Hepsipay, is a great example of realising BNPL. Developed specifically for the needs of the e-commerce giant Hepsiburada, Hepsipay comes with all of the basic fintech features, with a twist of the ultimate e-commerce e-wallet features—and BNPL comes in the first place.

3- AI Adoption

The adoption of AI in the fintech industry is rapidly increasing, with many financial services firms recognising the potential cost savings and efficiency improvements that AI can bring. According to research from Autonomous Research’s London-based NEXT unit, which focuses on fintech and the future of finance, the global financial services industry could see cost savings of 22% by 2030, totalling $1 trillion. This adoption is driven by many factors, including the need to improve customer experience, reduce costs, and increase the speed and accuracy of financial processes. Many financial institutions already leverage AI for tasks such as fraud detection, risk assessment, and customer service. The trend is expected to continue in the coming years as AI technology continues to evolve and improve.

Subtech and regtech are two areas within the fintech industry that are particularly suited to the use of AI. Subtech, or financial technology that focuses on the subprime market, often uses AI to help assess the creditworthiness of individuals and small businesses that may not qualify for traditional loans. Regtech, or regulatory technology, uses AI to help financial institutions comply with complex and constantly changing regulatory requirements.

Another area where AI is widely adopted in the fintech industry is natural language processing (NLP). NLP is a type of AI that enables machines to understand and interpret human language, and it is used in various applications within the financial sector. For example, NLP is used to analyse large volumes of unstructured data, such as customer feedback or social media posts, to gain insights and improve customer experience. We already see it being used in virtual assistants to enable more natural and effective communication with customers, and in a future where branchless banking is the new norm, NLP will be one of the backbones of the industry.

4- Marketplace Banking

Another one of the most significant fintech trends in recent years has been the rise of the marketplace banking model. The marketplace banking model involves the use of online platforms to connect borrowers and lenders directly, bypassing traditional banks as intermediaries.

The fintech industry has been at the forefront of this shift, with many companies offering marketplace lending and borrowing services through their platforms. This model has a number of benefits, including lower costs, faster turnaround times, and greater accessibility for borrowers. It has also opened up new opportunities for investors, who can now easily access a range of lending opportunities through these platforms.

While the marketplace banking model is still in its early stages, it is expected to continue to grow and evolve as more fintech companies enter the market and as traditional banks increasingly adopt similar models.

5- Conventional – Digital Bank Partnerships

The implementation of open banking and the PSD2 have played a significant role in the trend of digital and conventional bank partnerships, and in today’s world, there’s no other way than join forces.

Digital and conventional bank partnerships are inevitable because they offer a range of benefits to both parties. For traditional banks, partnering with digital banks allows them to tap into new markets and customer segments, as well as access innovative technologies and business models. Digital banks, on the other hand, can leverage the resources and reputation of traditional banks to expand their reach and credibility.

Furthermore, the rise of fintech and the increasing demand for convenient and accessible financial services make it necessary for both types of banks to work together in order to stay competitive. This is reflected in the statistic from PwC, which shows that 82% of financial service providers plan to increase partnerships within the next five years. Overall, partnerships between digital and conventional banks make sense as they allow both parties to capitalise on each other’s strengths and adapt to the changing landscape of the financial industry.

One example of a successful partnership between a traditional bank and a fintech company is the partnership between US-based CBW Bank and Moven. The partnership involves CBW Bank integrating Moven’s technology into its banking platform, which allows CBW Bank’s customers to receive real-time insights into their spending and saving habits. The partnership not only brings CBW Bank’s customers access to innovative financial tools but also helps the bank stay competitive in the digital age.

Another example of a partnership between a traditional financial institution and a fintech company is Visa’s partnership with Ingo. Through this partnership, Visa and Ingo are working to eliminate paper checks, which have a value of around $33 trillion. By partnering with Ingo, Visa is able to leverage Ingo’s technology to digitise check payments and make the process more efficient and convenient for consumers and businesses. These examples illustrate the trend of digital and conventional bank partnerships and the value that these partnerships can bring in terms of access to new technologies and markets.

6- Sustainability in Finance

There is a growing demand for sustainability within the finance industry, as more and more individuals and institutions recognise the importance of reducing their carbon footprint and promoting sustainable practices. This trend is reflected in the fintech space, where a number of companies are partnering with sustainability-focused organisations and adopting a sustainability mindset in their operations. In 2021, sustainable bonds reached $1trn, growth spearheaded by green bond issuance. This represents a 20-fold rise in six years and accounts for 10 per cent of global debt markets.

Sustainability in finance trend is expected to continue to be a major force within the fintech industry as more companies seek to align their operations with sustainable practices and as consumers become more concerned about the environmental impact of their financial decisions.

7- Integrated Finance

Integrated finance, or the integration of financial services into other platforms or applications, is one of the key fintech trends in recent years. Connected finance apps, also known as “super apps,” offer a range of financial services, such as payments, loans, and investment options, alongside other non-financial services, such as shopping, transportation, and communication. These apps are popular with consumers because they provide a one-stop shop for all their needs, and they are also attractive to businesses because they can help drive customer engagement and loyalty.

Integrated finance apps are key to scalability in today’s world, where every company is becoming a fintech company in one way or another. This is because they provide a platform that can handle a large volume of transactions and users without incurring high additional costs. Thanks to automation technologies, partnerships, and collaborations, the ability to scale operations efficiently is easier than ever for companies in the fast-growing and competitive fintech industry, and integrated finance apps offer a solution that can help businesses expand their operations and reach new markets.

As a result, the trend towards integrated finance is expected to continue in the coming years as more companies look to provide a range of financial and non-financial services through a single platform in order to meet the increasing demand for convenient and seamless financial experiences. Thankfully, it’s now easier than ever to build a “kinda-super app” with third-party SaaS and PaaS partners like Tmob.

As a SaaS and PaaS company that partners with the leaders in the fintech industry, we offer a range of innovative solutions designed to meet the needs of businesses of all sizes. Our MFS (Mobile Financial Solutions) Platform is a powerful SaaS and PaaS solution that offers a range of customisable features, including P2P money transfer, end-to-end payment options, enhanced data collection, and top-notch analytics. This platform can be easily customised to fit the needs of any business and works seamlessly on both digital and physical platforms.

In addition to our MFS Platform, we also offer Future-Ready Fintech Solutions that can help your business stay ahead of the curve. These solutions are designed to be highly customisable and adaptable to any kind of app, so we can easily integrate them to meet the needs of your business. With our MFS platform and Future-Ready Fintech Solutions, you can have any feature you need without spending months on coding. The possibilities are endless, so don’t hesitate to contact us to see what you can achieve with our fintech platforms.