3 Global Brands & 40 Million + Active End-Users take advantage of the power of our MFS Platform

3 Global Brands & 40 Million + Active End-Users take advantage of the power of our MFS Platform

MFS Platform

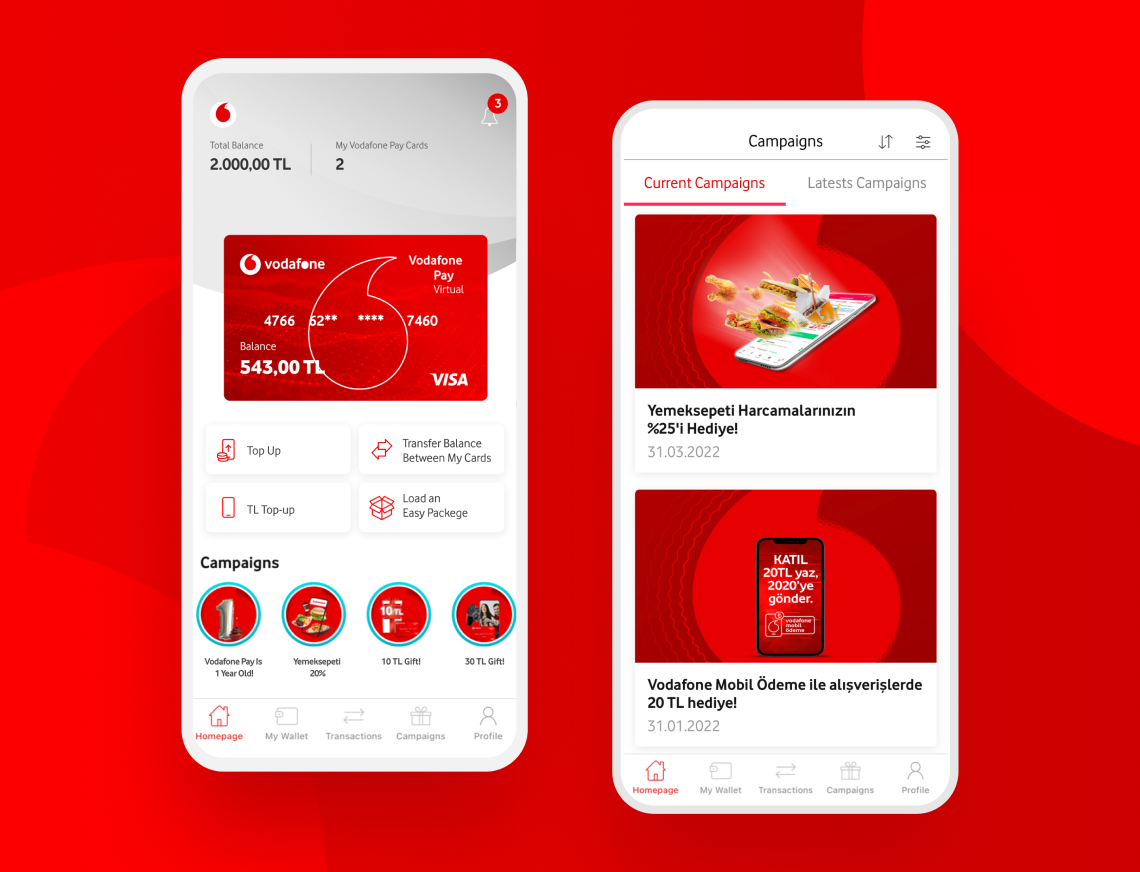

Our Mobile Financial Services platform provides a unique and breakthrough digital experience, carving out new revenue streams using a customisable & innovative digital wallet platform for telcos, e-money and eCommerce players around the world with 40 Million + active end-users.

Our innovative solutions help you to create digital payment ecosystems and increase financial business efficiency while expanding your customer base. Develop new revenue streams to increase lifetime revenue, and obtain more insights through data about consumers to improve loyalty programs and retain your customers.

Platform Highlights

Platform Benefits

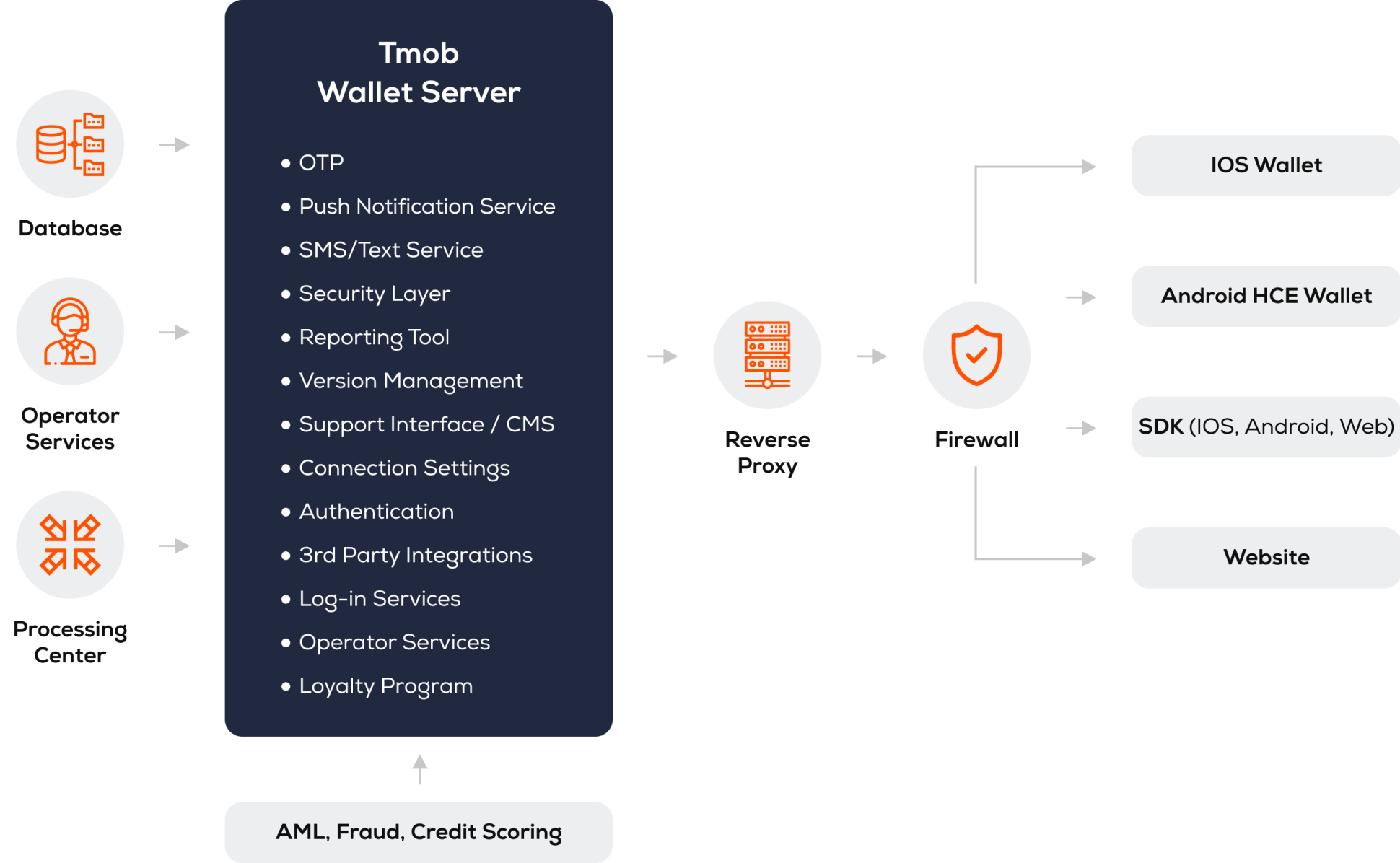

MFS Features

MFS Wallet Server & Services