Paycell by Turkcell

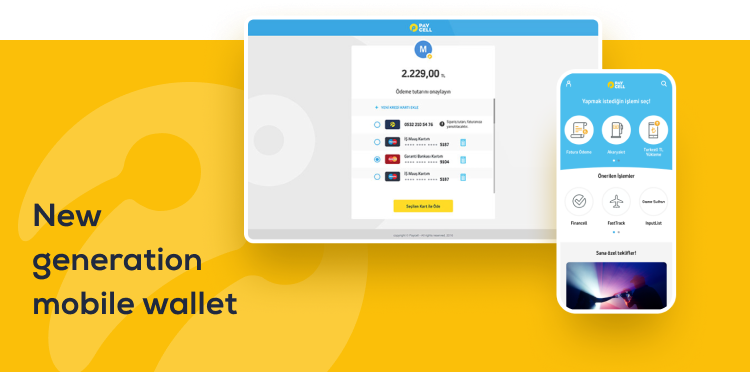

New generation mobile wallet reached more than 8M users with 50% increase in revenue potential.

The leading telco of Turkey

GSM-based mobile communication in Turkey began when Turkcell commenced operations in February 1994. Since then, it has continuously increased the variety of its services based on mobile voice and data communication, as well as on its quality levels, and as a result, its number of subscribers.

As of 2015, Turkcell’s target has been to become an integrated communication and technology services player in the region, operating a converged mobile and fixed network platform and offering a wide range of innovative products and services. Turkcell believes that it is important to offer our consumer and corporate customers the full range of our mobile, fixed and broadband services to meet their expectations.

Turkcell

Realization: 2017 March

Turkcell

Realization: 2017 March

Connecting people, financially

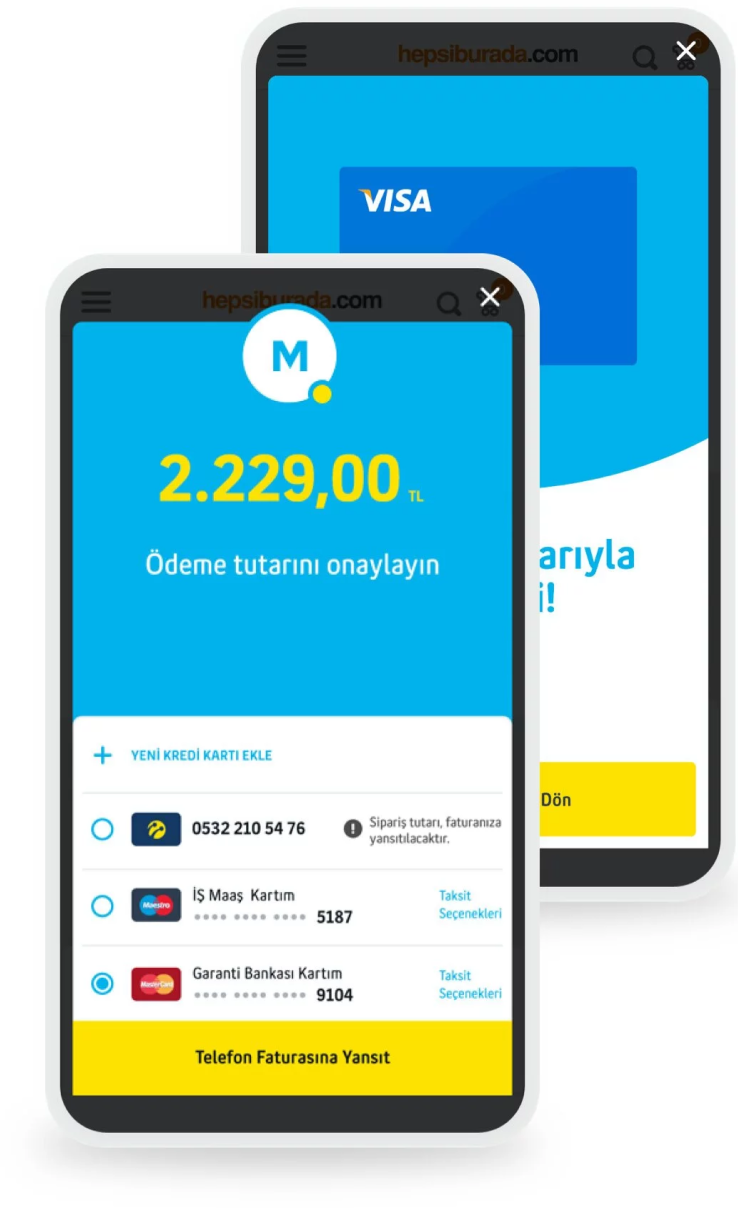

With their massive reach, telecommunications companies are the perfect candidates to take advantage of fintech & mobile payment solutions, and in a country where there’s an undeniably high number of unbanked people, Turkcell wanted to broaden its services in the financial area. The company wanted to offer their customer base a simple payment tool that takes seconds to sign up and be part of the digital financial ecosystem.

Financial literacy for everyone

Turkcell wanted to create a new mobile financial service in order to be one step ahead of its competitors. They wanted us to create a new system that includes all the innovative functionalities that exist in other mobile payment solutions but also to add new features that simplify its partners’ daily life and business integrating our mobile wallet platform. To sum up their objective was to create a new mobile payment platform to revolutionize the payment perception of all its partners and clients.

Why did Turkcell choose Tmob?

As a SaaS and PaaS powerhouse that’s experienced in financial services of almost every kind, we offered to customise our seamlessly working Mobile Financial Solutions Platform to Turkcell for their mobile payment service. For Paycell, we picked the most fitting features of our platform and added the new ones that Turkcell needed. In the end, we managed to create a mobile payment service for millions of users in a shorter project time than expected.

Our solutions

We picked the best mobile payment features for Paycell to create a fast & easy mobile payment experience for the users of the telco.

One-stop for all daily finances

We designed Paycell as a one payment hub for every account. Its simple interface offers a better, more easily navigatable user experience than many e-banking apps, which makes it a favourite payment powerhouse for millions of users.

A new revenue driver for the biggest telco in Turkey

Paycell Mobile Wallet brought a new revenue stream for Turkcell. After the launch of Paycell, about 1.5 million credit card users signed up while 8 million Turkcell customers have started using Paycell as a payment method. With Paycell, they won the Most Successful Mobile Application Award by Turkcell Partner Program. As there are still 30 million potential Turkcell users to use Paycell, they are expecting at least 50% increase in revenue by 2023.

1.000.000+ Downloads

8 Million Paycell Users

30 Million More to Grow

Tmob’s mobile wallet platform has greatly simplified our mobile financial service development. The platform allows us to quickly gauge its impact, to integrate easily our new partners to the system, to develop new mobile tech solutions for our clients and much more. Best of all, it integrates a variety of payment solutions into one central platform, which makes our mobile financial service more proactive.