The Open Banking & E-Banking Revolution in the UK

The finance industry has long accepted that the new form of banking is already not what it used to be. Online banking has become the new normal, and today, we are on the verge of an even more impactful revolution for the whole finance industry, with open banking regulations.

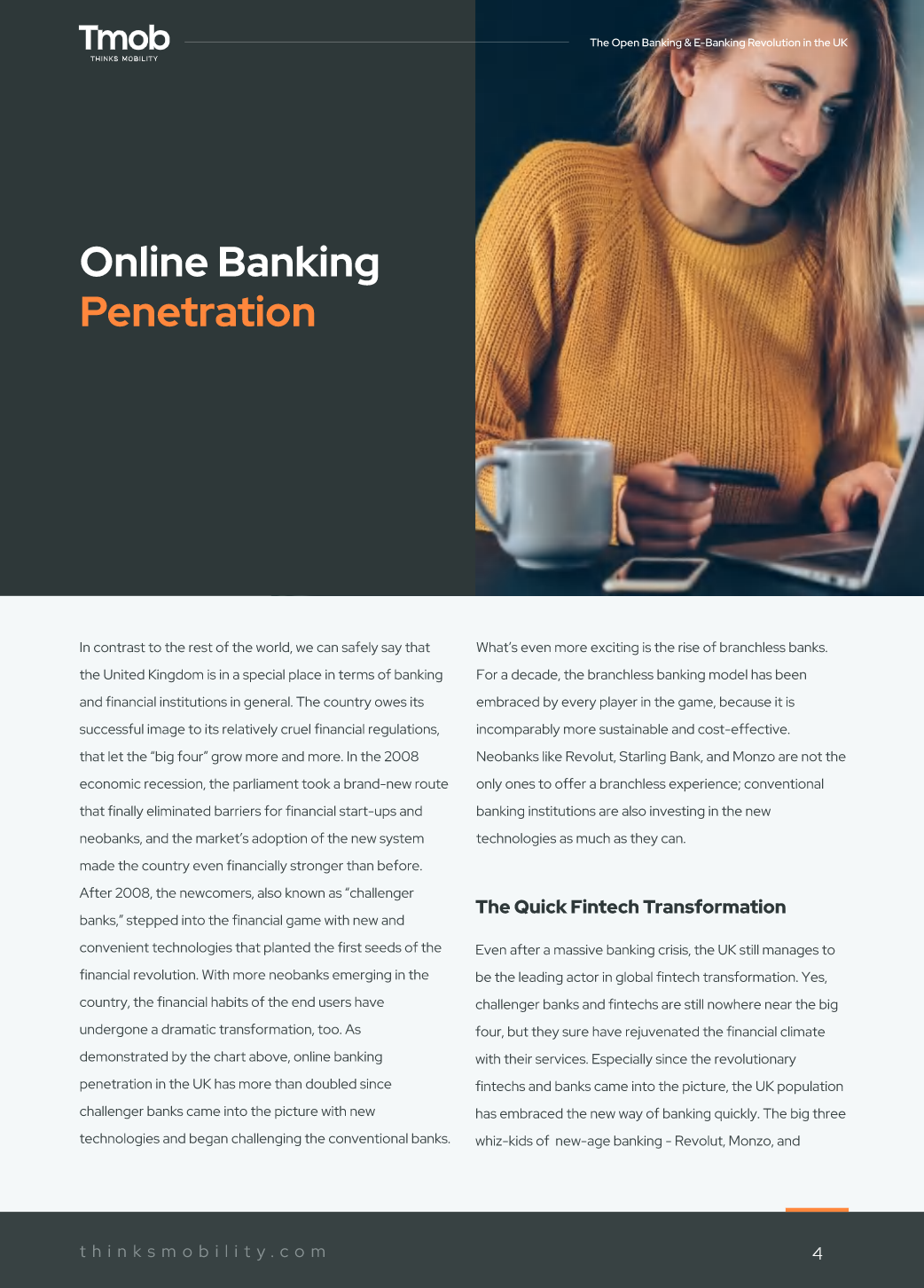

Open Banking Penetration

Neobanks like Revolut, Starling Bank, and Monzo are not the only ones to offer a branchless experience; conventional banking institutions are also investing in the new technologies as much as they can.

How Does E-Banking Thrive with Open Banking?

onventional banks, fintechs, and neobanks are all on the verge of a transformation and, as we mentioned above, innovation and agility are the key factors to winning the new era of banking.

A Turning Point for the Finance Industry: Open Banking

Open banking lets bank APIs, fintechs and other third-party apps share account data in a safe and controlled way. This opens a door for super-apps to become even more powerful.

What you will see

In this whitepaper;

- Online Banking Penetration

- A Turning Point for the Finance Industry: Open Banking

- How Does E-Banking Thrive with Open Banking?

- Tmob E-Banking Platform: What We Offer